The limitations of smart bidding and why your paid search campaigns deserve more

Arguably the biggest innovation the paid search industry has seen in the past decade is the advent of Smart Bidding, Google’s automated bidding solution. I remember when I first entered the industry as an Account Coordinator… Ah, the good (or bad?) old days. A majority of my time was spent manually updating CPC bids for every keyword in my client’s Google and Bing Ad accounts. I would analyze how each campaign was pacing toward my client’s KPI and calculate new bids multiple times a week.

Enter Google’s tROAS and tCPA smart bidding strategies. I remember my Google account reps encouraging my team to test these automated strategies and how skeptical we all were. The only automated bidding we had heard of in the past was through Marin! But as the years went by and Google’s automation won more and more bidding tests, Smart Bidding became the norm.

Now manual bidding is a thing of the past – manual CPC isn’t even an option anymore. And what paid search marketer isn’t relieved to be freed of the tedious tasks associated with manual bidding?

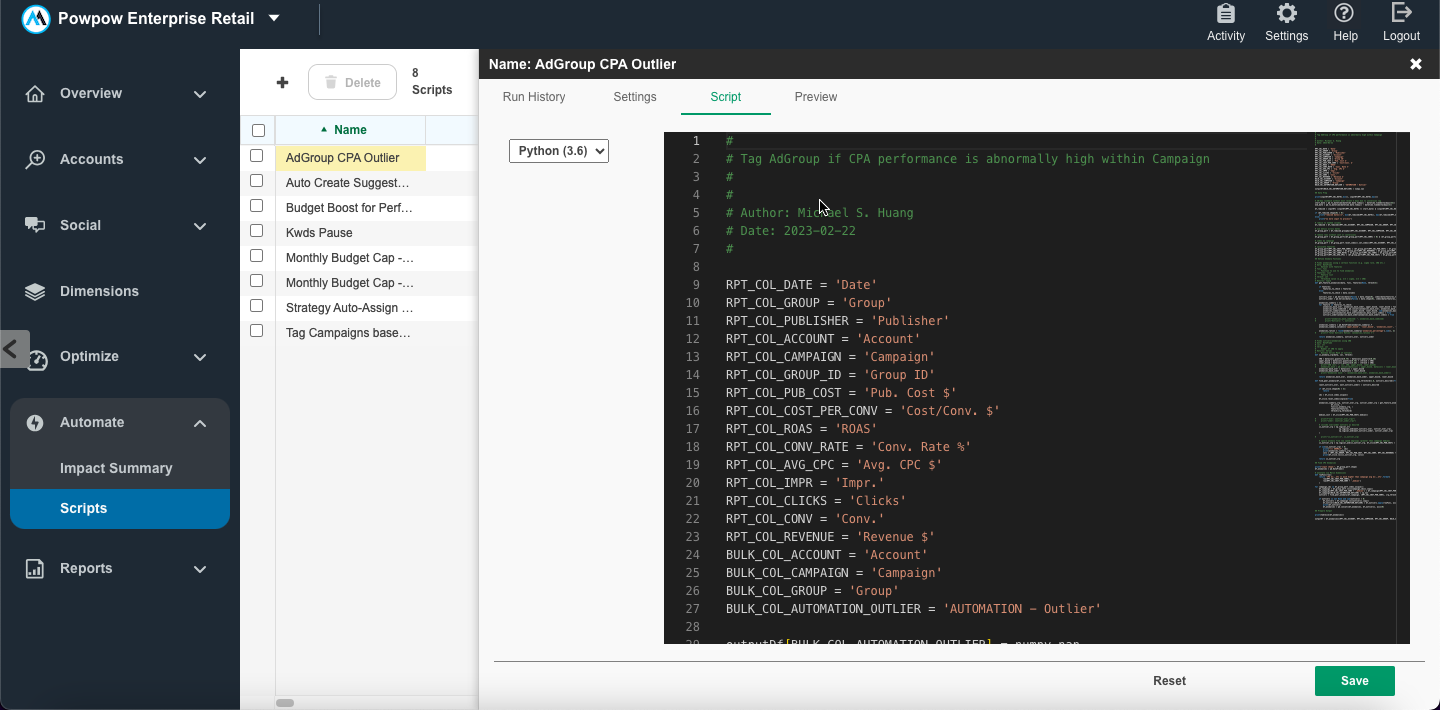

These publisher bidding strategies are great… but they’re an incomplete solution. What if you want budget pacing, not just ROAS or CPA, to be considered in bidding decisions? Can you ask Google’s algorithm to do that? Not without a complex custom script… and I certainly don’t know how to code.

Managing budget pacing still requires manual intervention – that is unless you use Marin! Read on to understand some of the ways Marin makes smart bidding even better.

Manage everything in one place

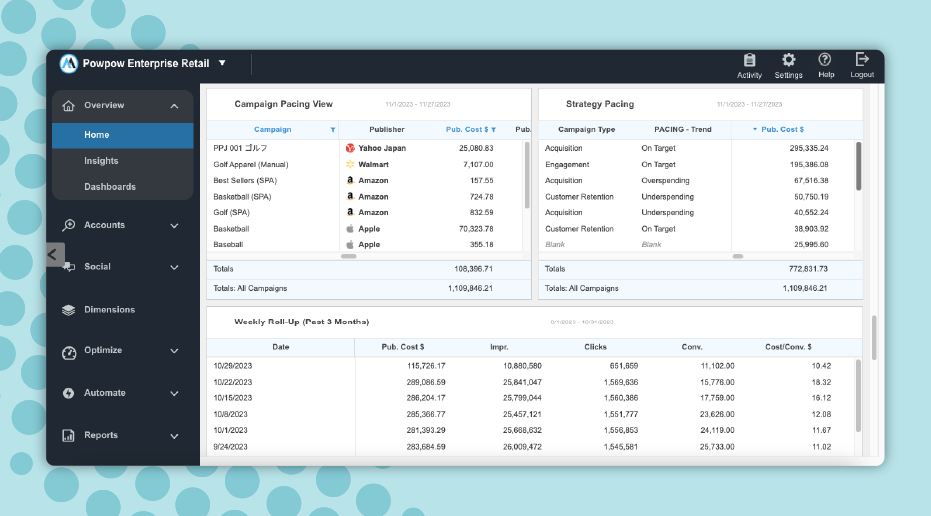

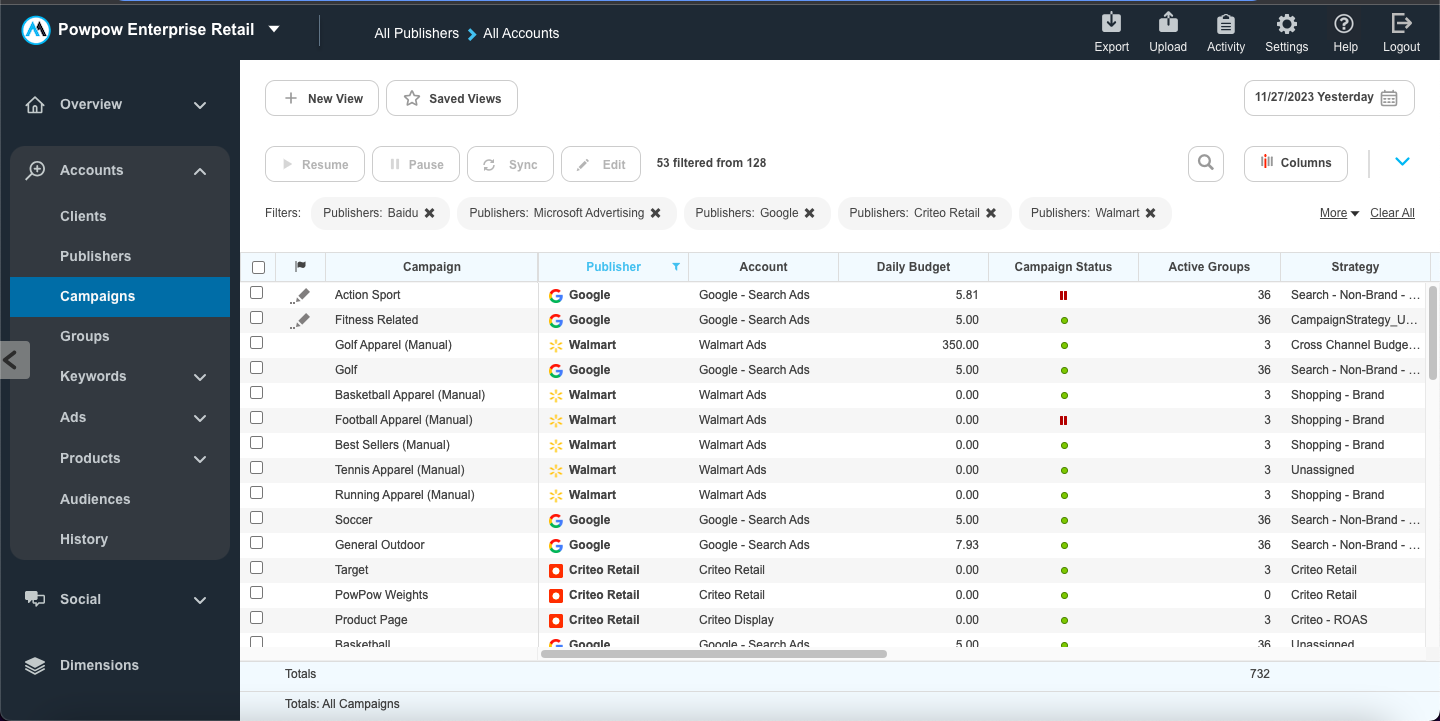

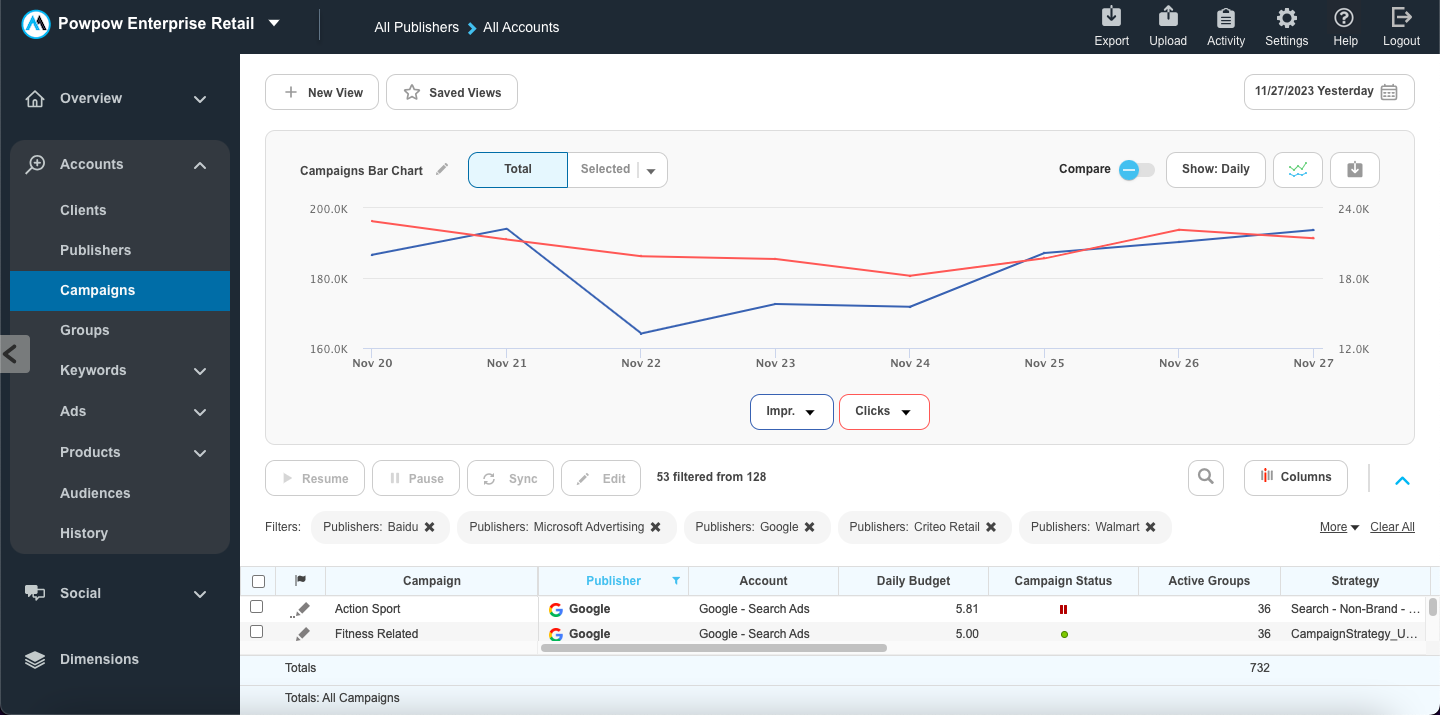

Jumping across publisher tools can be time-consuming and fragment your workflows and data. With Marin, all your different campaigns across Google, Bing, LinkedIn, Facebook, and more are unified in one UI.

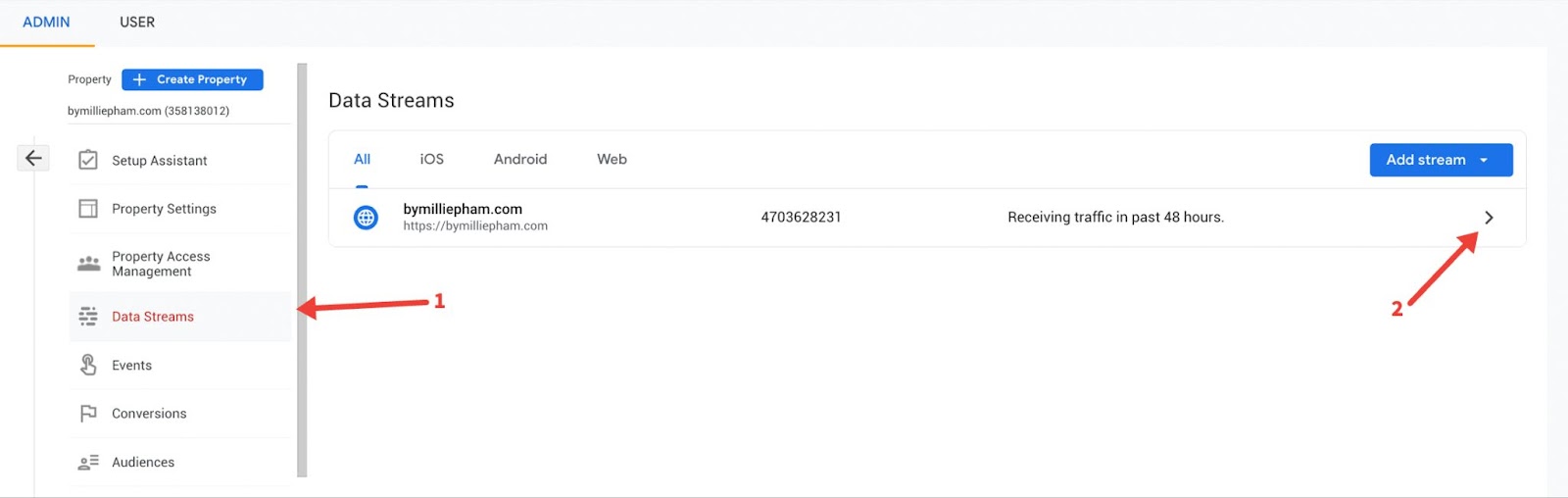

Marin unifies publisher data from tools like Google and Microsoft ads with backend data from tracking solutions like Google Analytics. We even have our own tracking solution, Marin Attribution, which is a more straightforward alternative to Google Analytics 4 (GA4).

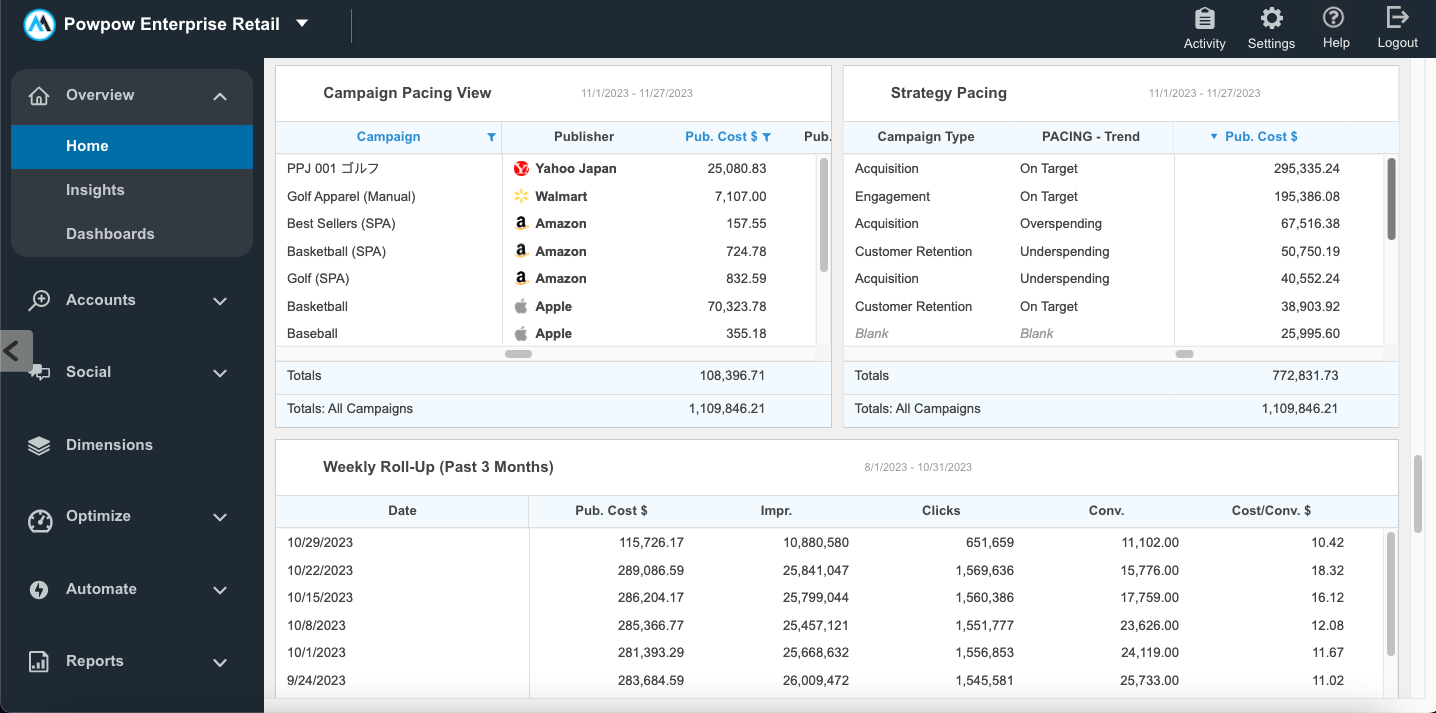

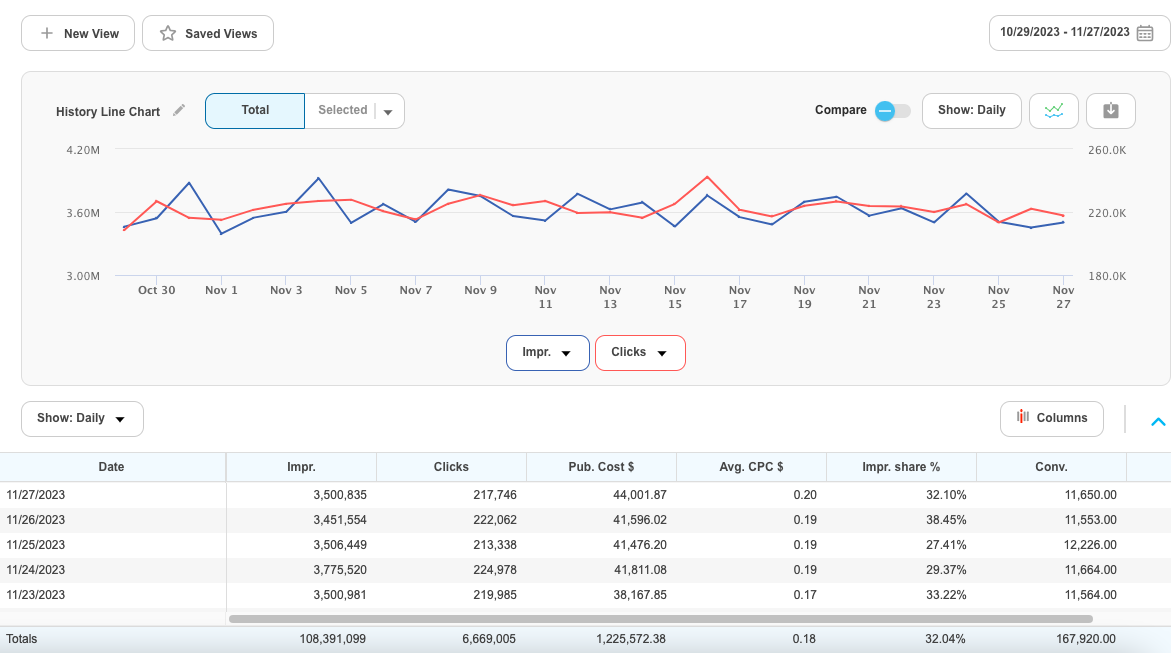

All that data comes together in our interactive, customizable reporting grids. From campaigns, all the way down to individual keywords, front-end metrics – like costs and clicks – are married to backend metrics – like conversions and revenue – and attributed to the correct source. You can even create your own custom columns with the calculations that matter most to you. That means no more spreadsheets.

Transitioning your reporting and analysis from an Excel grid to the Marin grid eliminates the need for any manual data wrangling, saving time and improving data accuracy. Check out how easy it is to analyze performance in Marin.

Marin makes it easier than ever to analyze cross-channel performance and clearly determine what is working well and what needs attention. If you decide to take any action based on that analysis, Marin makes that process easier than ever, too.

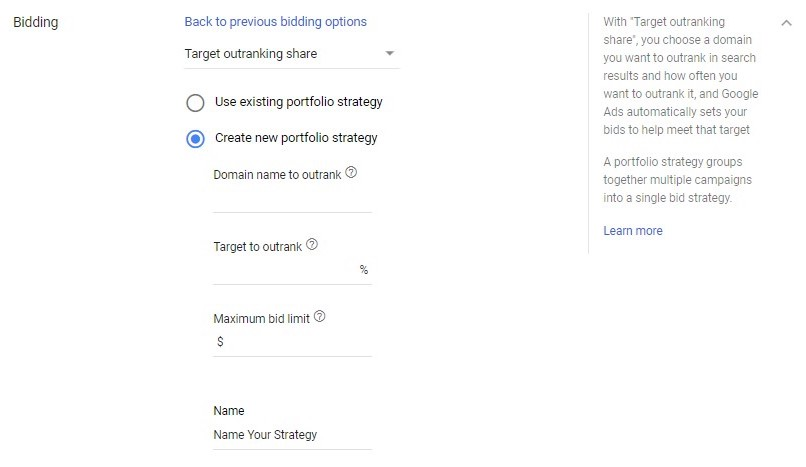

Edit smart bidding settings across publishers

After using Marin’s reporting grid to determine what’s working and what’s not, you can use our multi-edit functionality to make changes. Update your smart bidding settings like strategy, target, bid cap, and more in Marin and avoid wasting time hopping between unintuitive publisher UIs.

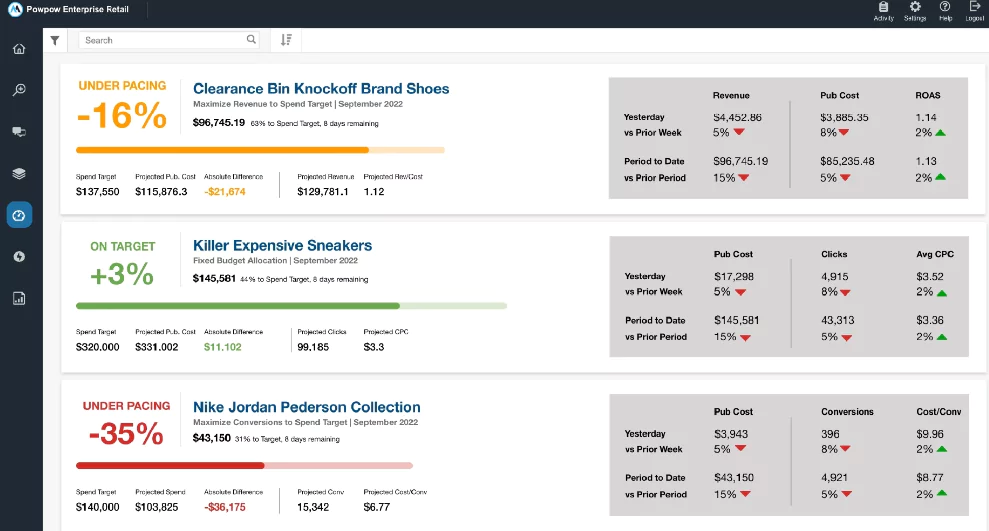

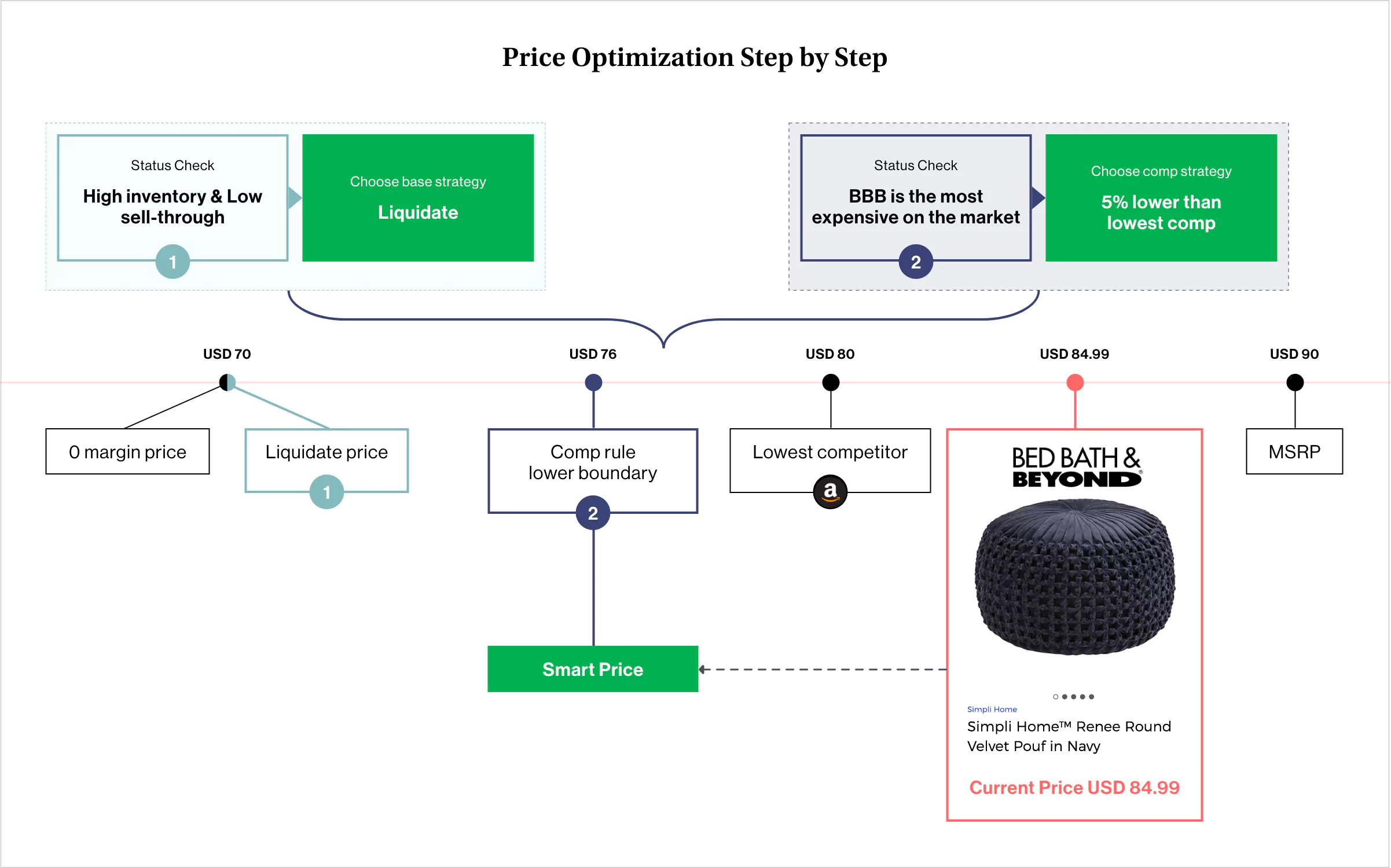

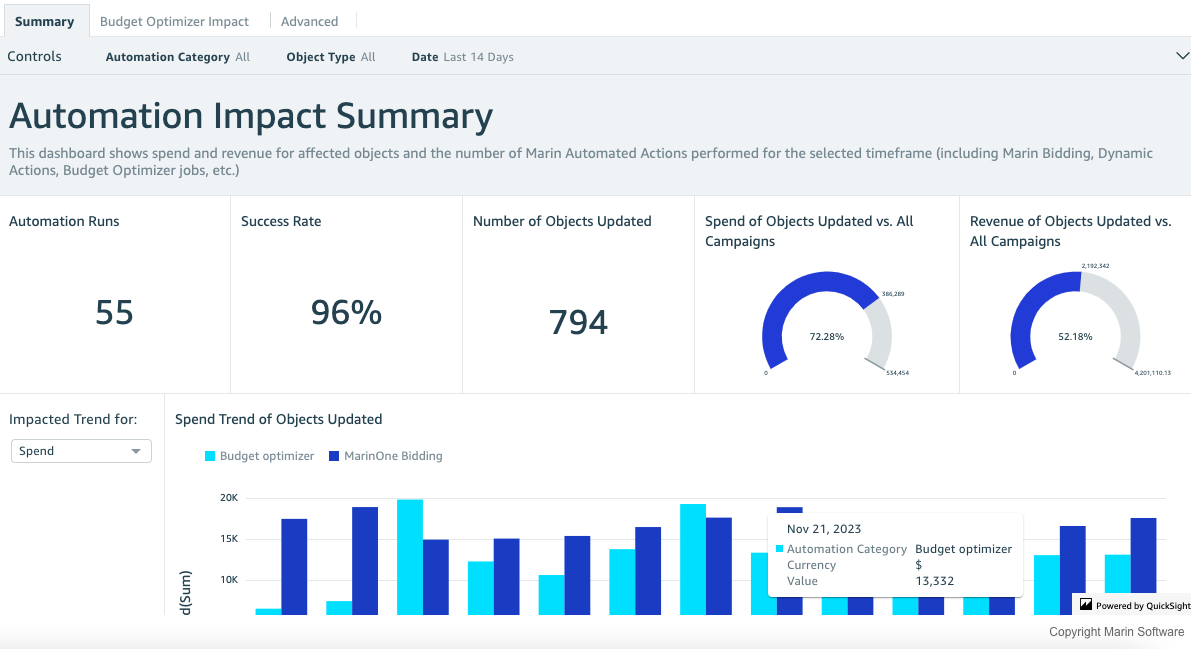

Maximize ROAS with Dynamic Allocation

If you find yourself grappling with questions of how much you should spend on each of your campaigns, let Marin solve them for you. Our budget allocation solution harnesses the power of AI to ensure your budget is distributed as efficiently as possible across campaigns and channels.

It all starts with your goals. First, you’ll meet with your Marin team to discuss your KPI targets and spend goals. Next, you’ll group your campaigns into different spend groups. Some examples of typical spend groups are brand, non-brand, retargeting, and prospecting.

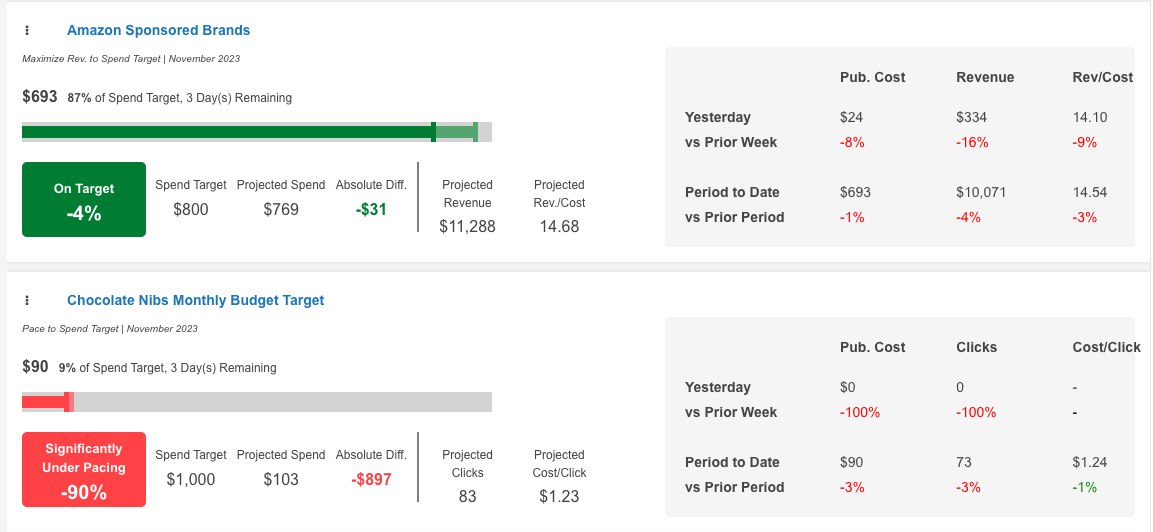

Marin’s AI will take it from there. It will analyze how each of your campaigns is currently pacing toward your KPIs and review impression share metrics to determine if there is more room for a campaign to spend in the SERP or if that campaign is already dominating. It’ll then allocate your budget across all the campaigns in the given bucket based on each campaign’s potential.

You can either auto-apply Marin’s budget recommendations, or review them in the Marin app and apply them manually as you see fit. Manage it all in Marin’s budget pacing dashboard, which showcases not only how your budget groups are pacing toward spend goals, but revenue and ROAS trends as well.

Get unbiased recommendations for improvement

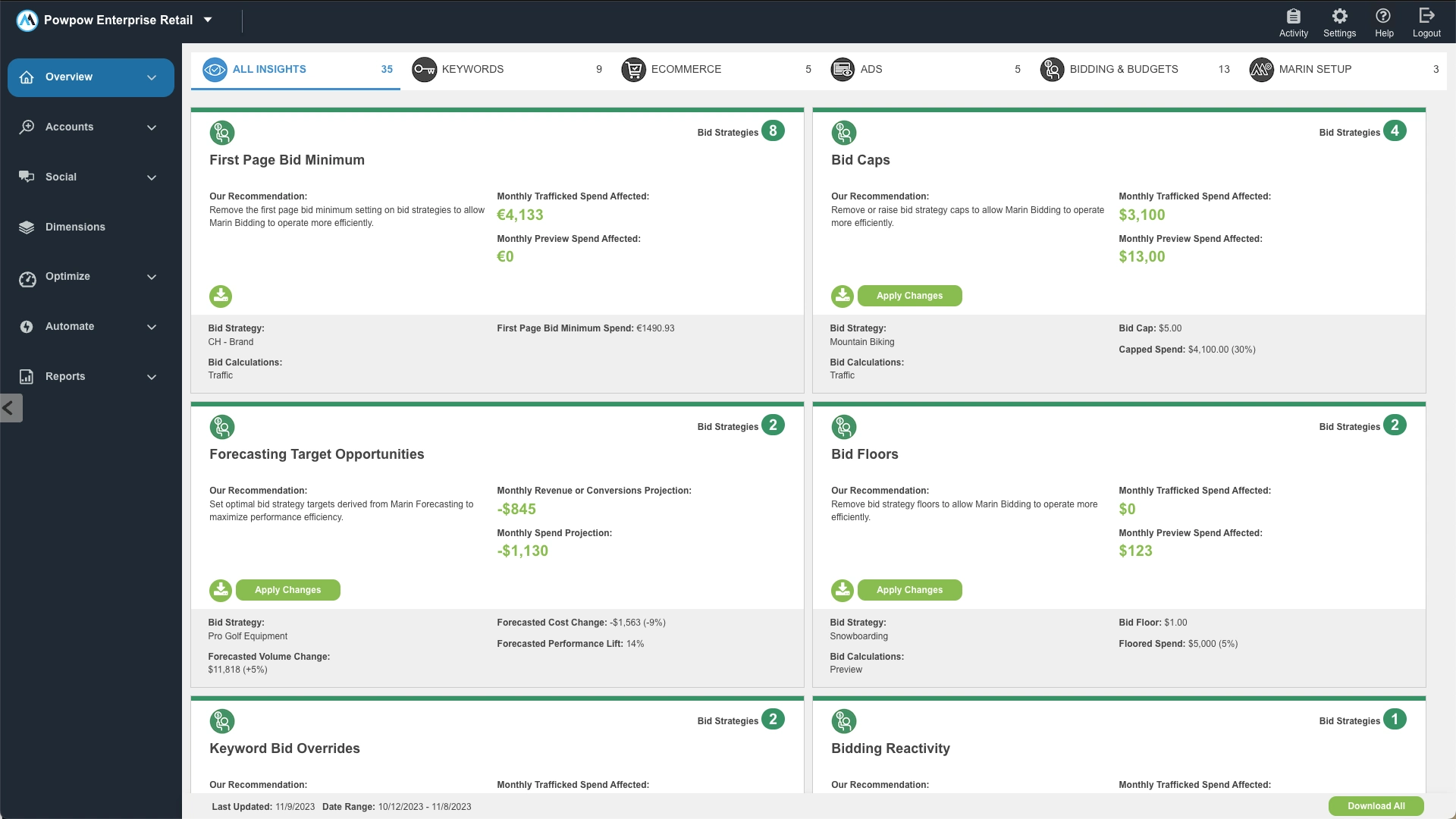

The publishers all provide recommendations to improve performance. But if you look closely, these recommendations always seem to lead to you spending more money on ads — not necessarily getting you any closer to hitting your KPI targets. Marin’s recommendation engine is free from publisher bias and has complete context on how all of your campaigns are doing across your customer lifecycle. This makes it more accurate than Google or Bing’s recommendations. And just like Google’s recommendations, they can be applied with one click.

In the modern paid media landscape, maintaining independence from domineering publisher tools is more valuable than ever. If our blog hasn’t convinced you of that yet, Marin’s unbiased recommendations will.

Say goodbye to publisher walled gardens

If you’re only using publisher tools for paid search media buying, you're limiting your marketing program. Marin can help you save time and improve your ROAS or CPA in countless ways. The best part? Marin is completely customizable. Unlike the publisher tools' one-size-fits-all approach, we can adapt our software to your business’s specific needs. Share your struggles with a Marin rep today and learn what we can do to help!

Meet your next Marketing Automation Platform

If you’re still unsure what Marin can do for you, see some of our favorite features in action.

Search is still queen of paid media, the bank to media network pipeline, what ‘key events’ in GA4 are, and more…

Hey Digital Darlings,

In the digital world, it seems like the more things change, the more they stay the same. In the change column, we see paid social continuing to grow in importance (and value) among digital marketers. But in “same-same” news, paid search is still the reigning monarch in the vast kingdom of paid media–clutching its crown with a cool $88.8 billion to show for it in 2023. Buckle up as we sashay through the latest digital drama, from Google's generative jests to Meta's chatbot chitchat.

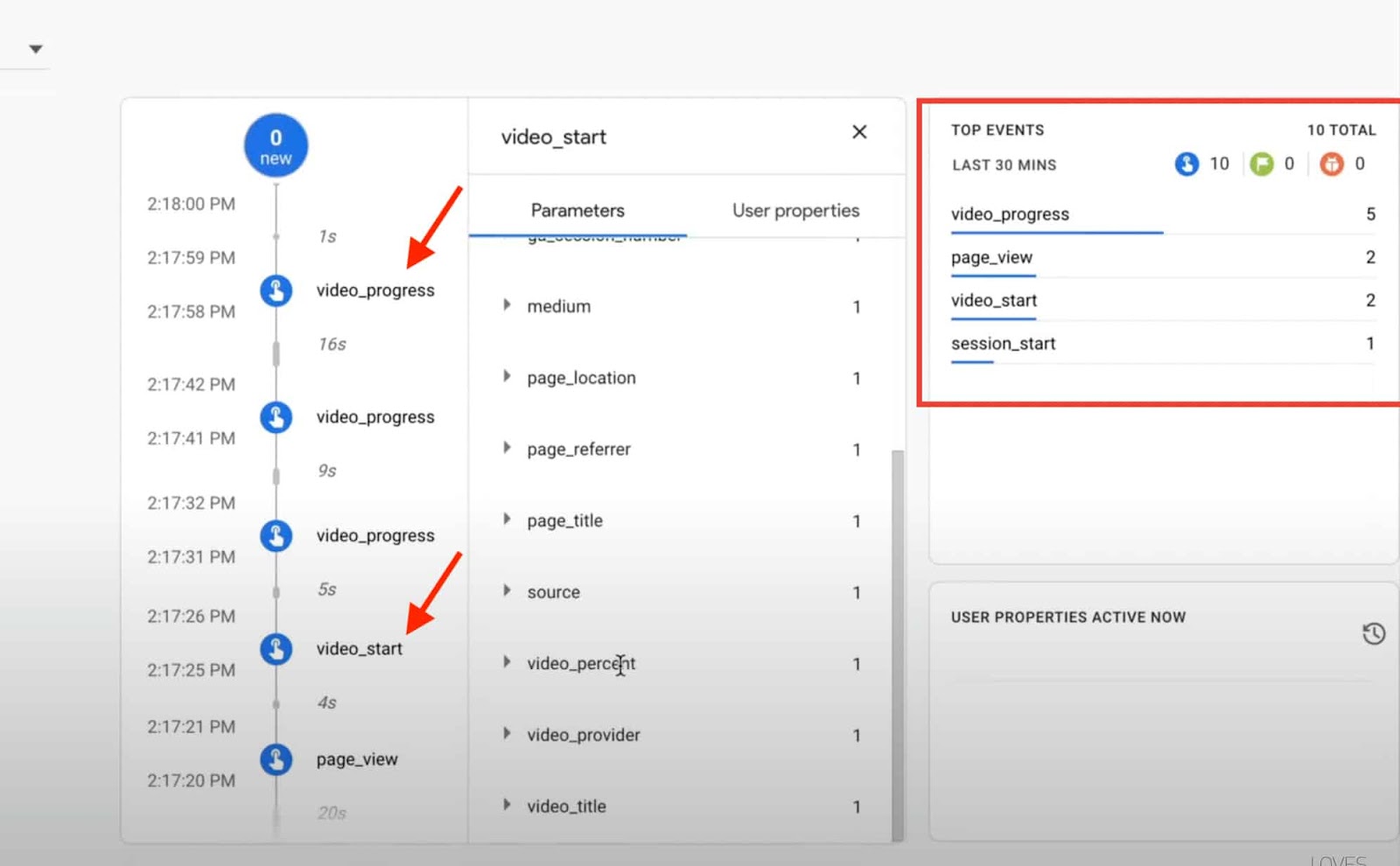

US search ad revenues hit a record high in 2023.

Paid search remained on top with digital advertisers for yet another year, accounting for $88.8 billion in ad revenues in 2023. That’s a 5.2% increase in revenue year over year. Despite the fact that paid search becomes more competitive and less transparent every year, it still drives better results than any other advertising channel. That said, paid search’s market share is slowly but steadily decreasing, thanks in large part to the rise of paid social. But paid social isn’t much more transparent than search, so I wouldn’t really call that a win… just a shift. In other paid search news…

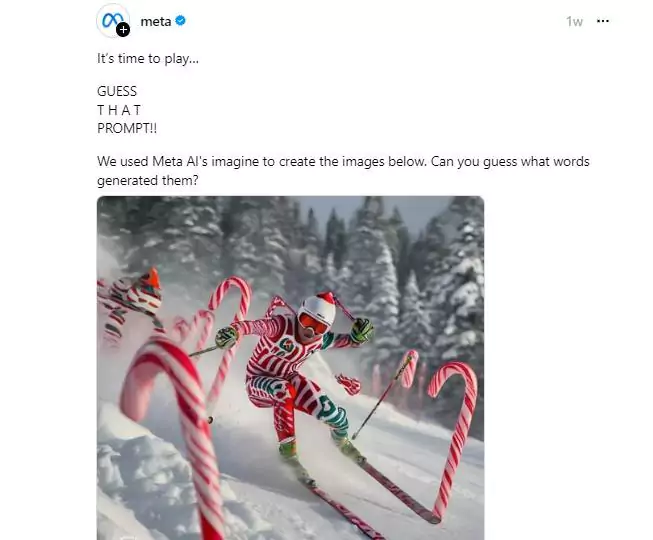

Google announced generative AI tools for Demand Gen campaigns.

The new tools create image assets using prompts that you provide. If you already have visual assets that are performing well, you can also use the tool to generate similar image variations. This makes it easier than ever to create visuals for Discover and YouTube Ads, but eliminates the need for a real, human creative team, which makes me sad. It’s interesting that these generative image tools are only available for PMAX and Demand Gen campaigns – two of Google’s newest campaign types that they’ve been pushing heavily since their inception. It’s yet another indicator that Google wants to automate everything. Regardless, it sounds like a helpful tool, and you can check out Google's guide to start using it. Now let’s chat about GA4…

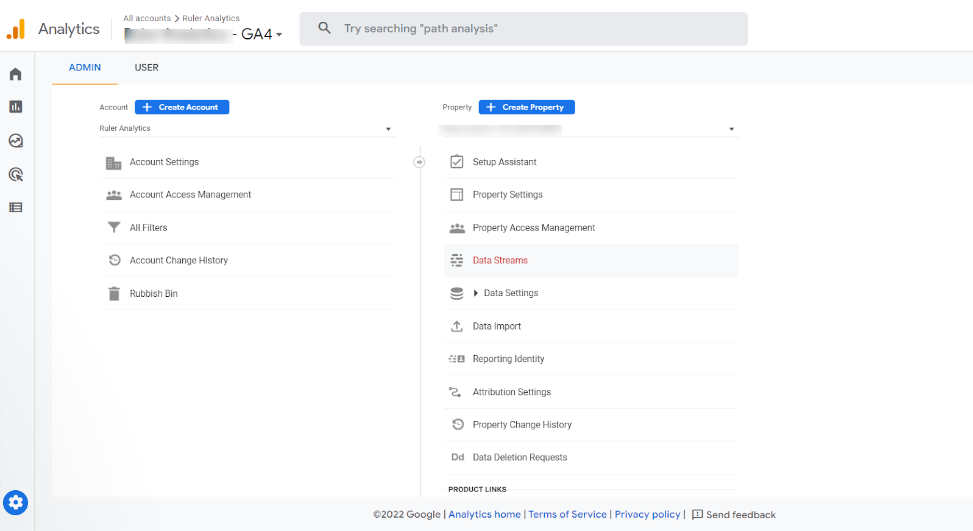

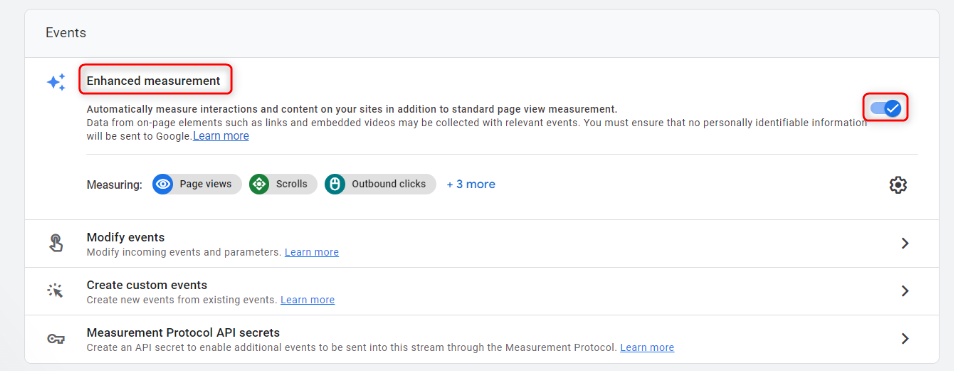

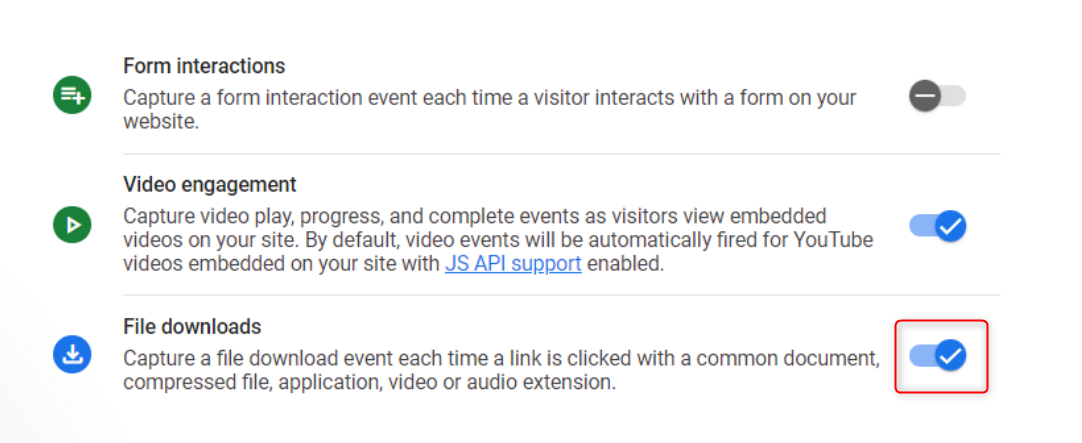

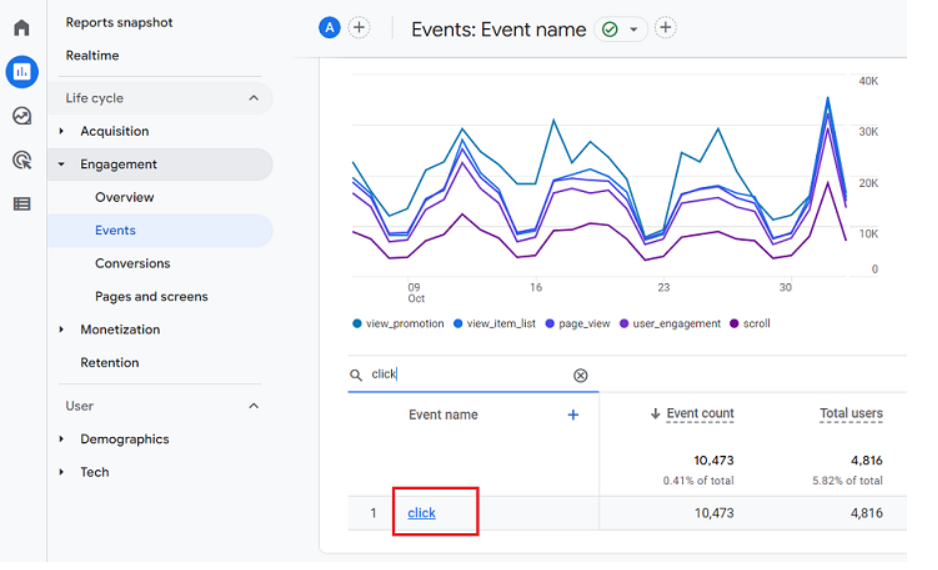

The shift from ‘conversions’ to ‘key events’ in GA4 is a game-changer.

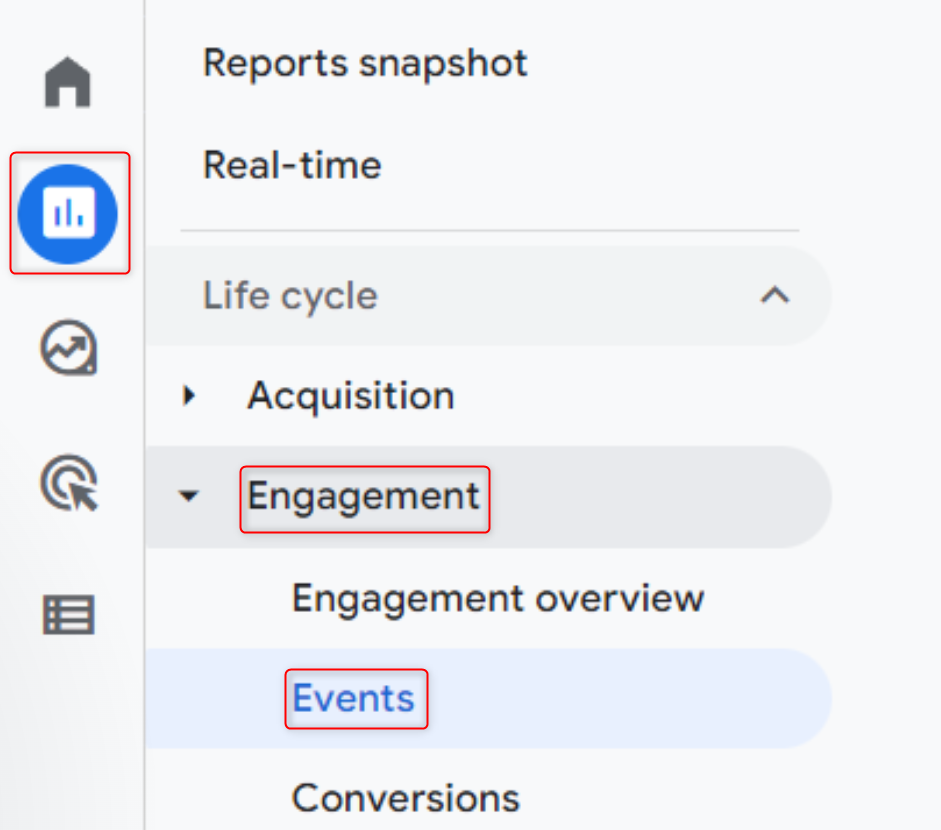

‘Key Events’ is a new term Google invented to distinguish Google Analytics (GA4) conversions from Google Ads conversions. Key events are important events for your business like subscriptions or purchases. This article from Search Engine Land outlined all the shifts in tracking from Universal Analytics (UA) to GA4:

- UA used data based on sessions; GA4 uses data based on events.

- UA measured bounce rate; GA4 measures engagement rate.

- UA used cookies; GA4 uses modeling to estimate key events.

- UA let you set up to 20 goals; GA4 lets you mark up to 30 key events.

- UA provided data; GA4 automatically provides anomaly detection.

- UA reported what users did; GA4 generates predictive insights.

- UA used last-click attribution; GA4 uses data-driven attribution.

These shifts make it easier to measure micro-conversions and assign monetary value to them, and also get more detailed insight into your customers’ purchasing journey. I found it really helpful to see all the changes laid out plainly. You can read more about the impact of these changes here. In other Google news..

AI spam is winning the SEO battle.

John Gillham, founder and CEO of AI content detection platform Originality.ai, said Google is losing its war on spammy content, and that “not all AI content is spam, but I think right now all spam is AI content." His team has been tracking the amount of AI content showing up on Google search results. Last month, 10% of results were written by AI, and that’s after Google claimed to take down a bunch of spammy, AI powered sites.

The Verge proved that point and trolled Google with an article titled “Best printer 2024, best printer for home use, office use, printing labels, printer for school, homework printer you are a printer we are all printers.” They used Google Gemini to write this satirical product review, and the article is now ranking in the #2 organic position on the SERP under a search for “best printer 2024”. Hahahahaaaa. The Verge did the same thing a year ago when they published this article (also about printers) written by ChatGPT, which also ranked in the top organic search results. It makes me wonder if Google’s March core update, which was supposed to reduce unhelpful, low quality, AI generated content, had any actual impact. Next up, more strange media news…

Chase (yes, the bank) launched an advertising network?

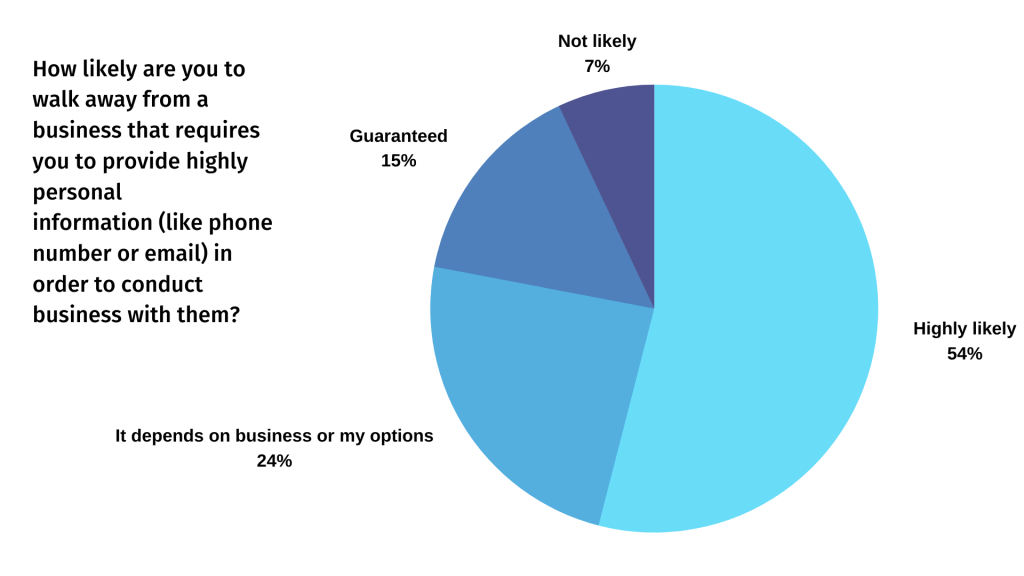

I guess it was only a matter of time before the bank processing the funds for the massive media buys wanted in on a piece of the action, but this was a bit of a surprise even to me. They recently launched Chase Media Solutions, the first bank-led media platform. According to businesswire “Chase Media Solutions combines the scale and audience of a retail media network with the exclusive advantages of Chase’s first-party financial data, institutional credibility and precise targeting capabilities.” As a consumer, something seems weird about the intersection of banking privacy laws and data brokerage and, I’m not gonna lie, this freaks me out. But as an advertiser, this seems like a good opportunity, as Chase’s first-party data enables advertisers on their network to target consumers based on purchase history. If you want to test out this new media network, you can contact Chase’s team here. And lastly, we have to dish about AI…

Meta put its chatbot in our Instagram DMs.

Which is cool, but it’s like… ask me first?? You can use it like a search engine and ask the AI questions, using the same flow that you would to DM a friend. This is a pretty smart way to drive adoption, TBH… But what’s in it for Meta? Are they using us to test their AI, or are they coming for the search game? With TikTok being a growing portion of Gen Z’s go-to search engine, the latter seems likely. Only time will tell.

And there you have it, my loyal readers—another whirlwind tour of this week’s digital marketing landscape. From Google's AI antics to the unexpected retail maneuvers by Chase, the plot only thickens. Until next week, stay sharp, question everything, and keep your strategies as bold as your coffee and your data cleaner than your browser history.

You know you love me.

The Essential Guide to Using AI Writing Tools for Content Creation

Gone are the days when content creation was solely the domain of human creativity and laborious hours of writing. Generative AI has created a seismic shift in how we conceive, produce, curate, and optimize content.

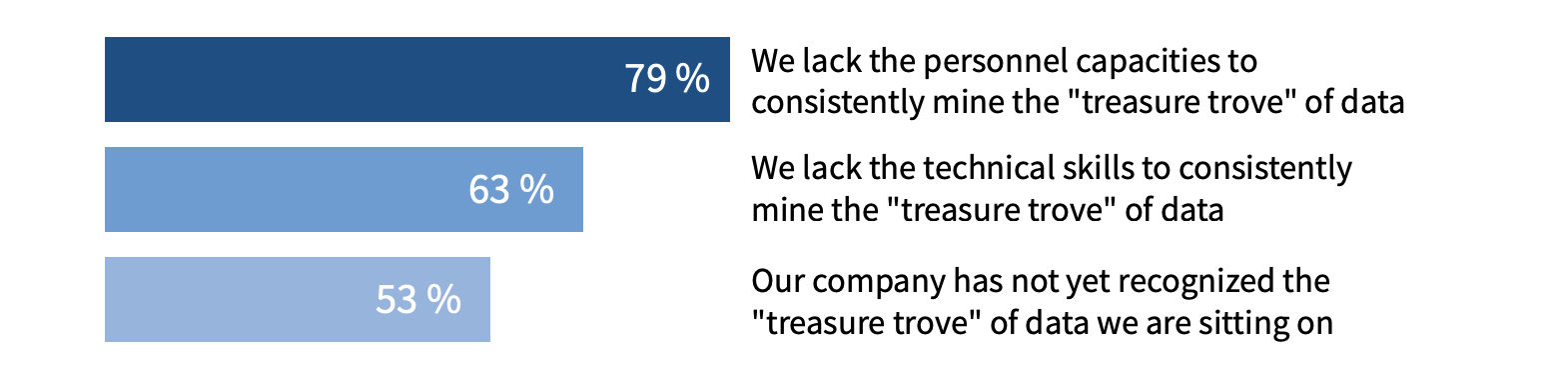

Despite generative AI's potential to transform the content writing process and create high-quality content, many companies have yet to adopt it. Often, their hesitation stems from a lack of familiarity.

This guide will help you navigate the transformative landscape of AI-generated content, highlighting its benefits and practical applications for enhancing your writing prowess.

Benefits of Leveraging AI in Content Creation

Improved Speed and Efficiency

According to Capttera, a staggering 80% of marketing professionals spend 50-75% of their time on content generation. Integrating AI in marketing workflows can help alleviate this burden and allow marketers to focus on more strategic tasks.

One of the most compelling benefits of AI writing tools is their ability to reduce the amount of time it takes to generate content. AI content generators can produce a draft in seconds, a task that might take a human writer hours or even days. Content writers also benefit from using AI assistants to revise content faster. These improved workflows create higher-quality content in less time.

For example, an AI email generator can swiftly craft highly personalized guest post outreach emails by analyzing a webpage in mere seconds!

Enhanced Creativity

AI writing assistants are also great creativity enhancers, helping broaden writers' creative horizons.

These tools can provide you with diverse angles and ideas. They can also help you overcome writer's block and keep your content fresh and engaging. For instance, tools like ChatGPT can be used to brainstorm unique topic ideas, titles, and outlines or experiment with different writing styles and tones.

Cost-Effectiveness

AI writers offer a more budget-friendly alternative to the traditional content creation process. Businesses can save on labor costs and allocate resources more efficiently by automating part of the content production process, especially for high-volume, repetitive writing tasks.

Additionally, the shift towards AI-driven content creation makes it easier for teams to work from home. Remote work thrives on flexibility and efficiency—hallmarks of AI-driven content creation. The adoption of AI-driven content creation tools minimizes the need for in-person supervision and supports remote teams by streamlining communication and project management. AI provides consistent quality and guidance, making remote collaboration as effective as face-to-face collaborations, if not more so.

AI makes content generation accessible to a wider range of businesses, from startups to established companies looking to scale their content marketing efforts.

6 ways to use AI to become a better writer

Wondering how you can start using AI for content creation? These budget-friendly strategies will help you become a more creative and efficient writer!

1. Brainstorm topic ideas

Seeking to establish authority or cover unexplored topics? AI can help you explore new angles and perspectives, enriching your content plan.

When asking an AI bot like ChatGPT to generate blog topics, your instructions, aka prompts, need to be as clear and specific as possible.

As the saying goes, "The Devil is in the Details". A good AI prompt is detailed, but still open-ended, allowing the tool to explore diverse ideas. A bad prompt is vague or overly broad, leading to generic responses that lack focus.

Giving the AI bot context about your business improves results. Tell the bot your job title and give it a link to your company website.

For example, instead of saying, "Give me 10 blog topics about technology," a more effective prompt would be "Act like you are a content writer for a healthcare company. Generate a list of emerging tech trends impacting healthcare in 2024. These topics will be used as blog posts on [insert website]."

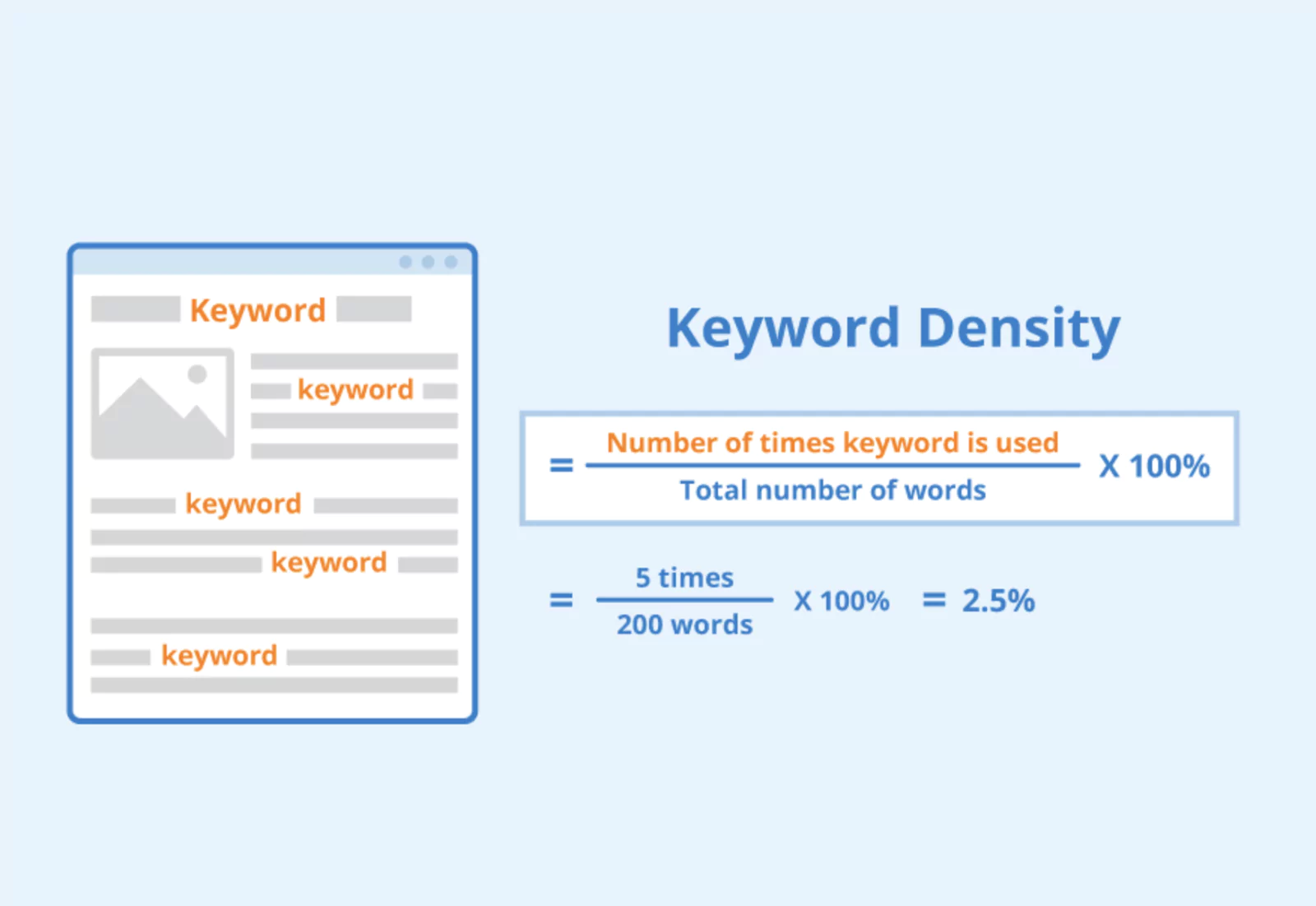

2. Create SEO-optimized titles and summaries

Use AI to generate SEO optimized titles and summaries for content you've already written.

The digital space is filled with AI content assistants that can create search-optimized blog post titles, TL;DRs, and outlines. Many of these assistants are available for free. Some of these tools require detailed prompts, like ChatGPT, while other tools created by SEO pros like Ahrefs and Copy.AI are more straightforward.

ChatGPT is an all-encompassing AI content creation tool. Simply feed it the content you're looking to summarize or create a title for, give it some business context, and watch it generate ideas. When writing your prompt, be sure to tell the chatbot that the results should be optimized for SEO.

Copy.AI offers a ready-to-use blog title generator. This tool requires minimal customization – simply input your target keyword or topic and watch the AI generate SEO optimized titles for you.

If you're looking for more precision and control over the output generated by the AI, try Ahrefs' Free AI Blog Title Generator. This tool is adept at crafting catchy, SEO-optimized titles. It lets you pick the tone of writing, generate multiple title variations at once, and provide context about the post's content, ensuring your titles resonate with your audience.

3. Generate drafts

AI writers are excellent at drafting content for blog posts, ad copy, product descriptions, and more. You can even integrate them with your social media management tools to help you create captions and social posts.

Once you've chosen your target keywords and finalized an outline, use AI writing software to create your first draft.

For platforms like ChatGPT, a detailed prompt is crucial. It should include all relevant information: the outline, desired keywords, conducted research, and specific facts or details. Explain the post's purpose, desired structure, and tone of voice. You can even feed it content you've written in the past, or provide a link to the landing page the content will eventually live on. This will enable the AI to create content that matches your writing style.

You can ask the AI tool to generate a complete draft or work alongside the tool and draft paragraph by paragraph. Many prefer the latter, as it allows for more control. Each time the AI bot generates a new paragraph you can give it feedback on length, amount of detail, relevancy, etc. This will help the chatbot learn to write better for you.

If you have a budget, try tools like Jasper AI or Surfer SEO. These specialized AI content writing assistants can truly elevate your content creation journey. They will walk you through the entire writing process and use advanced AI copywriting to streamline the journey from idea generation to published piece.

Unlike ChatGPT, these user-friendly AI content tools offer step-by-step guidance and pre-designed templates, making them ideal for beginners.

Remember — AI-written drafts need revision and fact-checking. Relying entirely on AI without any editing from your side can cause serious issues. We'll cover that later.

4. Improve clarity and fix grammar

Certain AI tools are designed to elevate your original content by enhancing clarity, engagement, and grammar. Two tools work exceptionally well for this purpose – Grammarly and the Hemingway App.

Grammarly, an AI writing assistant, catches spelling, punctuation, and grammatical errors. It also offers suggestions for enhancing clarity, conciseness, and tone. Simply copy and paste your draft into the tool or use the browser extension for real-time feedback.

Hemingway App, another powerful AI content writing tool, focuses on making your writing bold and clear. It rewords complex sentences, passive voice, and other readability issues.

While both tools have different strengths, they complement each other well. Combining these tools will benefit use cases like editing blog posts, email content, or any other written material.

5. Add unique images to your work

Incorporating captivating images into your content can significantly enhance its appeal.

Here are some of the best AI image generators:

- DALL·E 3 stands out for its ease of use, making it an excellent choice for those new to AI content generation. Simply describe the image you want and use the AI to generate it.

- Midjourney is known for delivering high-quality image results. This AI tool caters to users seeking exceptional visuals.

- For those desiring more control over their creations, Stable Diffusion provides extensive customization options.

- Adobe Firefly excels in integrating AI-generated images into existing photos. This AI is great for enhancing existing visuals through a blend of creativity and realism.

When using AI to create images, select a tool that aligns with your specific needs—be it ease of use, quality, customization, or integration. The vast number of AI tools available means there's a solution for virtually any visual content requirement.

6. Get feedback

AI can help you identify areas for improvement and refine your content. Here are a few examples:

- Paste your content into a tool like ChatGPT and ask it to improve clarity and readability. You could also ask it to add more details or examples to support your points.

- Try AI content writing tools like Surfer SEO or Frase for SEO optimization. Get recommendations on keywords, headings, and content length to improve search rankings.

- Use AI writing software to align with Google's EEAT (Experience, Expertise, Authoritativeness, and Trustworthiness) principles. EEAT is Google’s guidelines for creating helpful, reliable, and people-first content. AI tools can help you find gaps in your content and suggest ways to showcase your expertise and credibility. Tools like MarketMuse or Clearscope are great for this.

Be specific in your prompts to get the most relevant feedback. For instance, ask, "How can I make this post more engaging for [type of audience]?" or "What can I do to SEO optimize this content for X keyword?"

These writing assistants can refine your work and guide you to adopt better writing practices over time.

How to avoid common mistakes when using AI writing tools

AI writing tools offer huge benefits for content creators. However, there are common mistakes to avoid when using AI to write. Here's how to navigate these pitfalls effectively:

- Editing, Proofreading, and Fact-Checking: Always review and fact-check AI-generated content to avoid misinformation. AI can make mistakes or draw flawed conclusions, so verifying the information before publishing is crucial.

- Feeding a good prompt: Provide clear, specific, and complete instructions to your AI writing tool. Include the content type, context, desired tone, and other relevant details. The more precise your input, the better the output.

- Adding Personality to AI Content: AI-generated text sometimes lacks personality or sounds generic. To stand out, infuse your voice and style into the content. Make edits and adjustments to ensure the final piece aligns with your brand and resonates with your audience.

- Ethical Content Creation with AI: Be aware of potential biases and discrimination caused by AI algorithms trained on biased datasets. Familiarize yourself with the subject to spot any AI hallucinations or incorrect information.

Embracing the Power of AI for Content Creation

AI writing tools offer incredible opportunities to speed up content production and inject new levels of creativity and efficiency.

But, it's important to remember that quality and ethics should guide your content. Use the AI-generated content as a springboard for your creativity, ensuring it complements rather than replaces your unique insights and expertise. Blend AI's efficiency with your creative flair.

A recent Deloitte study examined how companies rate the readiness of their staff for adopting generative AI (GenAI). Almost all companies think their workforce is at least slightly prepared for AI. Only 13 percent say they are totally unprepared.

AI-powered writing tools are not a fad. They continue to evolve and become more integral to our content creation processes. So, get ready now!

Ad Strength isn’t real, Meta’s algorithm is glitchy, new ops for shopping ads, and more…

Hey Digital Darlings,

Do you believe in Ad Strength? In a young marketer’s heart? How the metrics can free her, wherever they start? I’m not so sure I do anymore… read on to find out why. Plus, we’ll dive into the latest shopping listing specs and marvel at YouTube's wallet-tempting updates. Time to decode what's truly driving our digital strategies and what's just smoke and mirrors.

Is ad strength a fake metric?

Lots of advertisers think so. It seems similar to quality score, but unlike QS it doesn’t impact ad rank. It actually doesn’t impact anything… it’s just a label Google gives your ads. Multiple industry experts have stated that some of their best performing ads have been labeled with ‘poor’ ad strength. To quote Mateja Matić, founder of Dominate Marketing,

“If you are new to Google Ads, one of things you need to be aware of is Google’s recommendations are not necessarily the best things for your account. I can tell you from experience that the majority of things they recommend in your account do not work as good as other things you can do to make your ads better.”

IKTR. My alter ego wrote a whole blog post about the fact that Google’s recommendations often align with spending more money on Google Ads, not improving your bottom line. So, we can’t trust Google. Shocker! But what do they have to say about Ad Strength? Basically, it’s supposed to be a diagnostic tool that tells you what’s working and what’s not. Google’s VP of Search & Commerce said,

“I don’t know where [the idea that Ad Strength is not important] comes from. Ad Strength is at the centre of what we’re trying to do is because creative is going to be incredibly important, and Ad Strength is going to be the mechanism which we use to evaluate that both in Performance Max and channels like search.”

Ummmm… sure. Ad quality is important. But in many cases, marketers are seeing their ads with the highest conversion rates having poor Ad Strength scores so… why on earth would they pay attention to ad strength? The moral of the story - focus on ads that are driving conversions for your business. In other Google news…

Google updated product specifications for shopping listings.

Six changes to attributes have already gone into effect. One of the most interesting changes is that if any of the text in your shopping ads and free listings was written by AI, you have to disclose that via an attribute. Other updates include a new loyalty program attribute, new minimum price attribute, and new free shipping threshold attribute. All this info can be displayed alongside your shopping ads and organic listings as Google’s algorithm sees fit, so things like free shipping callouts could definitely boost your conversion rates. Seems like a helpful update, so make sure you add those attributes in Google Merchant Center. There are more changes coming in September, and you can read up on all the details here. Speaking of shopping…

YouTube announced four new shopping features.

Please pray for my wallet. These updates make it easier than ever to buy stuff that’s featured in YouTube videos… and YouTube hauls are my vice.

The first new feature is called Shopping Collections. This seems to be modeled after Amazon storefronts and LTK pages. YouTubers can add all their favorite products to collections that viewers can shop on-site. Basically, it allows content creators to curate their own online store, and likely get affiliate revenue from the products they feature. A smart move on YouTube’s part, but dangerous for the shopping content-loving girls.

Additional updates include a new affiliate hub which helps creators find sponsored products to feature, the ability to tag products across multiple videos at once, and an integration with Fourthwall. If you’re a retailer, I’d make sure your products are featured in that affiliate hub, because these influencers are powerful. Now, let’s dish about some Meta Drama…

Sales are down, cost is up thanks to Meta’s glitchy algorithm.

Sales and ROAS have plummeted for Meta advertisers in recent months. Meta has given no explanation, so naturally everyone is blaming the algorithm. With CPMs tripling, some advertisers are reallocating their Meta budget to competitors like TikTok. Meta better fix that algo ASAP, because they’re currently expediting TikTok’s takeover. The issue isn’t impacting everyone, but if you advertise on Meta, keep a close eye on your ROAS, and reallocate budget if needed. And finally, let’s chat about AI…

WPP is collaborating with Google’s Gemini AI

WPP is the world’s biggest advertising group, so this is a big deal. They’ll be using Google’s AI to create ad copy and images, meaning the next big Coca-Cola ad could be created by Google’s robots. If everything goes smoothly, this will be a cultural reset for AI in marketing. If Google’s AI works for WPP, it could work for all of us, saving us time while hopefully not replacing our jobs altogether…

And there we have it—another week of digital deciphering down. From questioning Google's opaque metrics to strategizing around YouTube's shopping spree enablers and grappling with Meta's costly conundrums, we're reminded that the digital marketing world is ever-evolving. Until next week, keep your eyes peeled, your strategies flexible, and your skepticism healthy.

You know you love me.

5 Ways Marin Makes Retail Media Marketing Better

Working in retail media is challenging, fast-paced, and certainly never boring. It’s one of the most competitive spaces for media buyers to operate in. You have to constantly keep your finger on the pulse of industry trends and optimize campaigns daily based on the ever-changing marketplace.

We feel your pain. And we know you’re good at your job. But everyone could use a little help from AI these days! No matter what type of product you sell, Marin can make your life easier.

Our platform was built by retail media marketers, for retail media marketers, because a niche industry requires a specialized solution. We also built Marin to be flexible and customizable so it can meet each user's unique needs. Here are five ways Marin can help you work less and smash your performance goals.

1. Let AI Handle Budget Allocation

Most retail media marketers manage many campaigns in different accounts and channels, and publisher walled-gardens can make it difficult to deploy automation across those channels. Marin was built to solve this problem. Marin’s dynamic budget allocation harnesses the power of AI to ensure your budget is distributed as efficiently as possible, across all your campaigns.

All you have to do is map each group of campaigns with a shared budget to a Strategy and set the spend target for the month or quarter. Then let us know what your goals are - ROAS, conversion volume, impression share, etc. Marin will take it from there.

By comparing each campaign’s performance against your KPI targets and analyzing impression share metrics to determine which campaigns have incremental room to drive more conversions, Marin will intelligently allocate your budget across all your campaigns in Google, Microsoft, Facebook, Meta, LinkedIn, and more. Goodbye, budget pacing spreadsheets!

The beauty of this solution lies in its customizability. We’ll start by meeting with your team and discussing your current budgeting workflow and goals. Then, your Marin team will customize the automation to meet your needs. You just sit back, relax, and watch your campaigns meet those spend targets every month.

2. Identify opportunities for growth

As a busy digital marketer, one of the worst feelings is knowing that there are opportunities to improve performance but not having the time to act on them. Between investigating the next steps and building bulk sheets, even the simplest optimization initiative ends up taking hours. But with Marin, you can optimize your accounts in seconds.

Marin runs hundreds of daily checks on every account linked to our platform and identifies opportunities for growth. From ad copy improvements to changes to bidding targets to improving account structure, Marin covers the basics for you so you can focus on high-level strategy. Recommendations can be applied with one click, so no manual work is needed to act on your Insights.

For example, the above Insight recommends that our client move their top-performing ads into individual dedicated ad groups. This will help them manage the bid for that specific product independently, which makes sense since it's driving so much volume. To act on this recommendation, they simply need to click ‘Apply Changes.’ Marin will then build the new ad groups and pause the ad in the old group for them. It’s that easy!

See it in action:

3. Auto-create ads based on your product feed

Once you link your product feed to Marin, there are countless ways to apply automation based on it. For example, Marin can automatically create a new ad every time a new product is added to your feed. This is extremely helpful for brands that continuously create new products and want Shopping Ad coverage over every product. Rather than spending time every day checking your feed for new products and creating ads for them, automate that tedious process with Marin.

And speaking of shopping ads…

5. Manage all your shopping ads in one place

Marin pulls all your Google, Microsoft, and Amazon shopping ads into one unified view and organizes them by SKU. Understand your top-performing SKUs across channels and compare the performance of different channels for the same SKU to see what's working and what's not.

Create and edit shopping ads with our multi-edit grids and bulk creation tool. No more jumping from one publisher tool to another. Manage it all in one Marin Grid. And speaking of all-in-one grids…

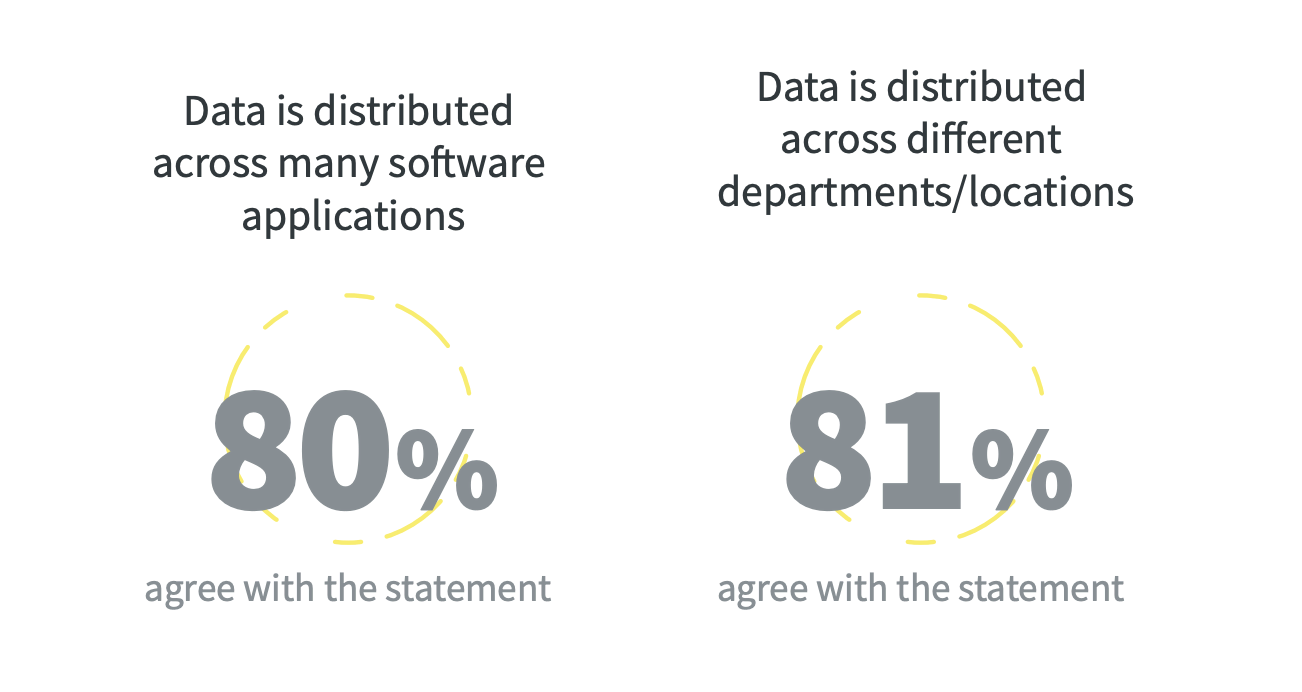

5. Harness the power of data unification

The value of using Marin to clean, unify, and visualize all your cross-channel data cannot be overstated. Our clients often describe Marin as a ‘mission control center.’ We integrate with all the major publishers and backend sources of truth. You can link as many different tracking sources as you want, from Google Analytics to Tealium to Marin’s own first-party tracking solution. Marin supports all the major ad formats like sponsored products, sponsored brands, Amazon DSP, and more.

Look how easy it is to link all your data sources:

Marin also solves the challenge of tracking conversions that start on other ad platforms but end on Amazon. For example, lots of retail media marketers include sitelinks to ‘buy on Amazon’ in their paid search ads. Additionally, marketers may drive traffic from ads on Meta to an Amazon storefront. If you’re just using the Amazon Ads UI for reporting, there’s no way to attribute those conversions back to their original source. Marin’s cross-channel Amazon Attribution solves that problem. You can see Amazon conversions attributed to the paid search or social campaign that drove the conversion right in the Marin UI.

With all your data unified and attributed down to the keyword/product level, reporting on performance has never been easier. Create saved views in our grids to capture data you reference often, or build a custom dashboard using Marin’s data visualization tools. Whether you’re an agency team reporting to a client or a brand reporting marketing performance to upper management, you’ll never have to manually wrangle your data again.

“Marin automates all of our reporting, performance monitoring, and optimization, saving us countless hours per week so we can spend more time focusing on strategy as we expand our presence globally.”

- Philip Ascott, Director of Digital at YOTEL

Check out how quickly you can respond to an ad hoc data request with Marin:

And there you have it! These are just 5 of the countless ways Marin improves the lives of retail media marketers. And don’t just take it from me, check out our case studies where real retail clients have shared their Marin success stories.

The thing that makes Marin more powerful than other marketing automation tools is its customizability. Our technical team will tailor the platform to your needs, and that starts at the very beginning, when you schedule a customized demo with us. We look forward to chatting with you!

How to Measure the ROI of Retail Media Marketing Campaigns: Key Metrics and Tools

Retail e-commerce sales are projected to exceed $8 billion by 2026. Businesses are heavily relying on retail media marketing to capture these sales, drive brand awareness, and improve customer retention. However, without a proper understanding of how these campaigns are performing, it’s nearly impossible to optimize and make informed decisions.

This blog post provides insights and strategies for measuring the return on investment (ROI) of e-commerce marketing campaigns. Learn about the key metrics and tools that can help track and evaluate the success of your marketing efforts.

The importance of measuring ROI in retail media marketing

Understanding and measuring the ROI of e-commerce marketing initiatives is essential for businesses to evaluate the effectiveness of their strategies and make informed decisions. Here are some reasons you should track and measure the ROI of your marketing campaigns.

Assess campaign effectiveness

By measuring ROI, marketers can determine which campaigns are generating the desired results. This allows you to identify which channels, ad campaigns, or promotional activities are driving sales and which ones are underperforming. These insights help allocate marketing budgets effectively and focus on the areas that provide a higher return.

Cost control and budget allocation

Social media platforms like Instagram and TikTok have become critical advertising channels for retail media marketers. Almost 60% of companies have seen an increase in sales made through social media recently. However, as more social media platforms come into prominence, marketers must allocate their budgets carefully. By understanding the ROI on various social media platforms, you can identify areas where you may be overspending or not getting the desired returns. With this knowledge, you can control costs, optimize your budget allocation, and ensure maximum revenue generation.

Enhance customer acquisition

Measuring ROI can help you identify the most effective customer acquisition strategies. By evaluating the ROI for different channels, such as paid advertising, social media marketing, or influencer partnerships, you can determine which channels deliver the highest number of customers at the lowest cost. This information enables you to focus your efforts on the most profitable customer acquisition tactics, ultimately leading to increased revenue and business growth.

Set realistic goals

Measuring ROI helps marketers set realistic benchmarks and goals for marketing campaigns by providing a detailed assessment of past performance that they can compare to industry standards.

5 Key metrics for measuring ROI in retail media marketing

Some key metrics include conversion rate, average order value, customer acquisition cost, customer lifetime value, and return on ad spend. Here is an overview of each of these metrics.

1. Conversion rate

The conversion rate metric measures the percentage of website visitors who complete a desired action, such as making a purchase or subscribing to a newsletter. A higher conversion rate indicates better campaign performance and customer engagement.

The formula for calculating conversion rate is:

Conversion Rate = (Number of Conversions / Number of Visitors) x 100

To visualize conversion rates, you can use various methods such as:

- Funnel visualization: This involves mapping out the various stages of your conversion process and using visual aids like flowcharts or real-time data visualization tools to track the percentage of visitors who move through each stage and eventually convert.

- Line graphs: You can plot conversion rates over time using a line graph to track fluctuations or trends in your conversion rate.

- Heatmaps: These can help you identify and analyze user behavior on your website or landing page by visually representing the areas where users are most engaged or dropping off, giving insights into potential areas for improvement.

2. Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) measures the amount of money spent on acquiring a new customer. By comparing the CAC with the average customer lifetime value (CLV), businesses can determine the profitability of their marketing efforts.

The formula for CAC is:

CAC = (Total Sales + Marketing Expenses) / Number of New Customers Acquired

To visualize CAC, you can use various methods such as:

- Bar charts: Use a bar chart to display the CAC for different time periods, campaigns, or customer segments. Each bar represents the CAC value, allowing you to compare and analyze the effectiveness of your acquisition efforts.

- Cohort analysis: Create cohorts of customers based on specific criteria, such as the month they were acquired, and analyze the CAC for each cohort. Visualize this data using stacked bar charts or line graphs to understand how the cost of acquiring customers varies by group.

3. Average Order Value (AOV)

AOV calculates the average amount spent by a customer in a single transaction. Monitoring AOV helps evaluate the effectiveness of upselling and cross-selling strategies.

To calculate average order value (AOV):

AOV = Total Revenue / Number of Orders

To visualize AOV, you can use several methods, such as:

- Scatter plot: Use a scatter plot to map the relationship between AOV and other factors such as customer age, geographic location, or order size. This visualization method helps identify any correlations or outliers that may influence AOV.

- Funnel visualization: Create a funnel visualization that shows the conversion rates and AOV at each stage of the customer journey. This visual representation helps track and identify potential areas for improvement in increasing AOV.

4. Return on Ad Spend (ROAS)

Return on Ad Spend (ROAS) measures the revenue generated for every dollar spent on advertising. It provides insights into the profitability of specific ad campaigns or marketing channels.

The formula for calculating return on ad spend (ROAS) is:

ROAS = (Revenue from Ad Campaign / Cost of Ad Campaign) x 100

To visualize ROAS, you can use various methods, such as:

- Scatter plot: Use a scatter plot to analyze the relationship between ROAS and specific metrics such as customer acquisition cost (CAC), ad spend, or ad impressions. This visualization method helps identify any patterns or correlations that could impact the ROAS.

- ROI dashboard: Design a dashboard that combines various visualizations to showcase your ROAS metrics and key performance indicators (KPIs) related to ad campaigns. This holistic view provides oversight of the effectiveness and profitability of all your different advertising efforts.

5. Customer Lifetime Value (CLV)

Customer Lifetime Value (CLV) assesses the total revenue generated by a customer over their entire relationship with the business. Evaluating CLV helps marketers understand the long-term value of acquiring and retaining customers.

The basic formula for calculating CLV is:

CLV = Customer Value x Average Customer Lifespan

Visualizing CLV can help businesses understand the long-term value of their customers and make informed decisions regarding marketing, customer retention, and customer acquisition strategies. There are various ways to visualize CLV, including:

- Line charts: Line charts can help businesses track changes in CLV over time and identify patterns and trends.

- Cohort analysis: Cohort analysis involves grouping customers based on when they made their first purchase and tracking their CLV over time. This analysis helps businesses understand how CLV varies across different customer segments.

- Heatmaps: Heatmaps can be used to identify specific customer segments with high CLV. By clustering customers based on their purchasing behavior and CLV, businesses can target their marketing efforts more effectively.

Tools and techniques for measuring ROI in retail media marketing

Various tools and techniques are available for measuring the ROI of e-commerce marketing campaigns. By leveraging these tools and techniques, businesses can track key metrics such as website traffic, conversion rates, customer acquisition costs, and customer lifetime value to accurately measure the success and profitability of their marketing campaigns.

Web analytics

Tools like Google Analytics provide valuable insights into website traffic, user behavior, conversion rates, and other essential metrics. By tracking these metrics, businesses can assess e-commerce campaign performance.

Marketing automation platforms

Marketing automation tools like Marin come with built-in analytics and reporting features. They help track marketing campaigns, lead generation, and conversions.

CRM systems

Customer Relationship Management (CRM) software allows businesses to track customer data throughout the sales cycle. CRM platforms like Salesforce or Zoho CRM provide insights into customer interactions and purchase history.

A/B testing

Running A/B tests allows businesses to compare the performance of different marketing elements, such as website layouts, call-to-action (CTA) buttons, or email subject lines. This helps identify the most effective strategies for improving ROI.

ROI calculation formulas

ROI calculation formulas can help businesses determine the financial impact of their marketing efforts. These formulas consider the cost of marketing campaigns and the revenue generated to calculate the ROI percentage.

How Marin can help you track and measure campaign ROI more effectively

Measuring the ROI of e-commerce marketing campaigns is critical to understanding the effectiveness of online business strategies. There are several key metrics and tools available to help businesses accurately track and optimize their campaigns, including AOV, ROAS, and CLV. However, the process of tracking and analyzing this data can be time consuming and complex.

With Marin, businesses can leverage advanced analytics and reporting capabilities to gain valuable insights into the performance of their campaigns. The platform provides a centralized hub where businesses can manage and optimize their campaigns, using machine learning and AI-powered insights to maximize ROI.

Start using Marin today to gain deeper insights into how your e-commerce marketing campaigns are performing.

Incognito Mode is fake, UA dies in July, Facebook and Netflix in cahoots, & paid search updates

Hello there, Digital Darlings,

Strap in for a wild ride through Tech Town. Google's dropping Universal Analytics like last season's trends, Microsoft's making bidding moves, and Incognito Mode's about as private as a reality TV show. Plus, Meta's mixing up targeting like it's a new cocktail recipe. Let's decode the tech titans' latest antics and arm ourselves for the battles ahead. First things first, this is your FINAL reminder that…

Google is shutting down Universal Analytics (UA) for real.

They sent out a mass email reminding us that on July 1st, Google Analytics 4 (GA4) will have fully replaced UA. All UA services and APIs will shut down forever. So if you’re still using UA for anything, it’s time to change that. You can follow Google’s migration guide to make the switch ASAP. In other Google news…

Google Ad Manager Reach Report error skewed data this week.

If you noticed some strange numbers in your Ad Reach report on Monday, you’re not alone. The issue actually lasted from Friday evening to Monday morning, but I really hope you weren’t working over the weekend, and therefore didn’t notice. Reach report data for any date later than March 20th was incomplete, depriving advertisers of their precious prior week’s data while they worked to pull together Monday’s reports. But don’t worry, Google resolved the issue Tuesday afternoon, so things should be back to normal. Now let's pivot to some Microsoft news…

Microsoft is phasing out Manual CPC this month.

All campaigns currently on Manual CPC will be automatically switched to enhanced CPC starting May 13. And manual CPC will no longer be an option when creating new campaigns starting April 30th. It’s probably for the best, TBH. Manual CPC doesn’t adapt at all to real-time auction data and puts you at an efficiency disadvantage. The only concern with eCPC is that Microsoft can increase your bids higher than the CPC you’ve set. But don’t worry, Microsoft won’t let your Average CPC exceed your bid, so you don’t need to worry about fluctuations in spend. And in other Microsoft bidding news…

Max Conversion Value bidding is now available for Microsoft Ads.

Maximize conversion value aims to drive the highest-value conversions possible. So while Max Conversions bidding drives as much conversion volume as possible, Max Conversion Value focuses on ROI. You can even choose to add a ROAS target to this bid strategy to make sure it’s bidding in line with your goals. If you’ve been using manual bidding, it might be time to test this strategy out instead! And in other tech news…

Incognito mode is fake! Chrome will not protect your privacy.

As part of a lawsuit settlement, Google agreed to delete “billions of data records” that they collected from users searching in Incognito Mode. The settlement also requires Google to update the Incognito Mode “splash page” (the blurb that pops up any time you open a new Incognito window) to state that they’re still collecting your data, no matter what browsing mode you use. It seems like all Incognito Mode does is prevent your site history from being saved in your browser. It doesn’t do anything to protect your data, and gives people a false sense of security. Time to switch to Duckduckgo! And in more scary (lack of) data privacy news…

Facebook lets Netflix read your DMs.

Court documents revealed that Meta has been giving Netflix access to users’ messages for the past decade. This info came out of a lawsuit where filers claimed Netflix and Facebook “enjoyed a special relationship” (lol) that enabled Netflix to tailor ads to Facebook users. In exchange, Facebook received billions of dollars in ad revenue from Netflix. I can’t say I’m shocked, but this seems super illegal. It all happened via an agreement that gave Netflix access to Facebook’s APIs. Fox Business said it best…

“The API agreement allowed Netflix programmatic access to Facebook’s private messages inboxes, in exchange Netflix would ‘provide to FB a written report every two weeks that shows daily counts of recommendations sends and recipient clicks by interface, initiation surface, and/or implementation variation (e.g. Facebook vs. non-Facebook recommendation receipts).’"

🎶 Meta and Facebook sitting in a tree, K-I-S-S-I-N-G 🎶

In other Meta news…

Meta made major targeting updates to Advantage+ Shopping Campaigns.

The updates allow advertisers to see reporting breakdowns on current audiences and target people who are interested in their products but have not yet made a purchase. The new reporting feature is called the “Engaged Customers Audience Segment” and is available in the Meta Ads UI now. Users can add the segment to any report by going to the ‘breakdown’ menu and choosing “Demographics by Audience Segments”. This will add segmented rows for ‘new customers’, ‘existing customers’, and ‘engaged customers’.

Additionally, you can create a custom audience out of your engaged customers to directly target people who are interested in your brand but have not made a purchase. It’s basically streamlined retargeting, and I appreciate Meta doing the work for us… but can we trust their data? Who knows!

Well, there you have it. Another week of every major tech company destroying my faith in humanity!! Until next week, keep your strategies sharp, your skepticism sharper, and don’t let the lack of data privacy get you down. The tech overlords are always watching, so make sure you look good!

You know you love me.

7 Ways to Improve Your Google Ads Click-Through Rates

Did you know that Google Ads usage is on the rise? Over 60% of online marketers use it.

However, 44% of them say they can’t achieve the return on investment they expected. This doesn’t mean Google Ads can’t be profitable for them. It can, but they need to apply new strategies to improve click-through rates and achieve better performance with their ads.

What is Click-Through Rate (CTR)?

Click-Through Rate (CTR) is the ratio of users who click on a specific link to the number of total users who view a page, email, or advertisement. In Google Ads, CTR is an important metric that measures your ads' success in attracting clicks from viewers. A high CTR indicates that your ad copy and targeting are relevant to the audience.

What constitutes a strong Click-Through Rate (CTR)?

CTR performance can differ based on the industry and type of advertisement. Google states that the typical CTR for search ads is 1.91% for the first position, 0.35% for the second spot, and 0.11% for the third spot. In contrast, display ads typically see a CTR of about 0.46%. While these figures can be used as a reference point, it's important to remember that your target CTR should align with your objectives and sector.

Based on our first-hand experience, here are 7 highly effective ways to improve your click-through rate in Google ads:

1. Use Dynamic Keyword Insertion

What marketer doesn’t love good targeting? Dynamic keyword insertion, an advanced feature introduced by Google Ads, lets you create more relevant ad copy based on a user’s search query.

Let’s say you’re advertising a coffee shop. In your ad headline, include the code {Keyword: coffee shop}. When a user searches for “best coffee shop”, Google will automatically change the ad headline to “Best Coffee Shop.” If they type “coffee shop near me,” the headline will change to “Coffee Shop Near Me,” and so on.

It’s a simple yet powerful method that tailors your ad to each unique user.

Bonus Tip: Pay Attention to Low Volume Keywords

Despite being underestimated, lower-volume keywords can help boost the number of people clicking on your ads. These keywords may not bring in tons of traffic. They are precise, so they will match with a lower amount of queries. However, paying attention to them can improve how relevant and appealing your ads are to an audience. Here are a few reasons why you shouldn't disregard them:

- They’re focused: Low-volume keywords tend to be very precise, which means that the users searching for them are likely close to making a decision or a purchase.

- Less competition: Few advertisers use these keywords, so your ads have a better chance of standing out and getting more clicks at a lower cost.

- Better conversion rates: Since these keywords closely match what the user is after, they often lead to high conversion rates.

By including long-tail keywords in your paid search strategy, you’ll boost your click-through rates and make your Google Ads campaigns more effective overall.

2. Set up Location Insertion

Now, let’s talk about advertising that hits home (literally).

Similar to keyword insertion, the location insertion feature automatically replaces the code {LOCATION(City)} with the actual city name based on the user's location or the location they're searching for. How is this possible? Easy! Google Ads determines the user's location based on their IP address.

3. Mix Things Up

Let’s say you’ve crafted a catchy headline and description for your ad. How do you make sure it stays fresh and relevant to your target audience?

Create multiple versions of headlines and descriptions. The golden ratio is to have 15 variations for headlines and 4 variations for descriptions.

Google will then mix and match your headlines and descriptions to display the most relevant combination to your target audience, basically doing A/B testing for you.

Before we move on, remember to "pin" important headlines or descriptions to lock them in a particular position. For example, you might pin your brand name to Headline 1 so that it appears first in every ad. This allows Google to create maximum variety with your other unpinned elements.

4. Use Symbols and Emojis

Sprinkle emojis and symbols in your ad text!

This will not only create eye-catching text that will stand out in Google Search Results, but you'll also add a touch of personality and flair to your message. That's what these symbols are for – to convey emotions and tone.

While there are no strict rules on how to use emojis and symbols in your ad text, here are a few tips:

- Do not overdo it: stick to one or two relevant emojis per ad.

- Mind the context: make sure your emojis and symbols are appropriate for your brand and message.

5. Apply the Rule of Three

Sometimes, ads hit your goals. Sometimes they don't. So why not run a small experiment instead of risking all your budget? Here's what you need to do:

1. Create three versions of the same ad, each with a slightly different message or call to action.

2. Run them for a limited time period (e.g., one week) and compare their performance metrics.

3. Choose the winning version and use it as an evergreen ad.

6. Use Google Ad Extensions

As you might have guessed, Google Ads Extensions extend your ad so it takes up more space on SERPs and has more clickable appeal. If you want to see your CTR climb, use extensions and be sure to include your brand’s name and logo (only verified advertisers can use this option).

Google Ad extensions have a lot of potential to boost your ad performance. Here are some great examples:

- Sitelinks: These extra links can guide customers to pages on your website. For instance, a clothing store could have ad extensions like "Women's Fashion," "Men's Collection," and "Kids' Wear" that link to dedicated landing pages for each of the product categories.

- Snippets: These highlight features of your products or services. A technology company might showcase snippets such as "Software Development", "Mobile App Solutions", "Cloud Services" and "24/7 Tech Support."

- Promotions: You can share offers directly in your ads. For instance, a restaurant could advertise "Get 10% off your order", or a bookstore might offer "Free shipping for orders over $50."

- Price Extensions: Display prices for products or services you offer, making it easy for customers to see upfront costs. For example, a beauty salon could list prices like "Haircut $30", "Manicure $20" and "Facial Treatments starting from $40."

- Locations: Businesses with multiple in-person locations can benefit from showing addresses and distances in their ads to attract customers. A coffee chain, for example, could display stores closest to users searching for coffee.

- Get the App Here: If your company offers an app, this tool can prompt users to download it from the advertisement. For instance, a fitness app could use this feature to attract users.

- Visuals and Multimedia: Images and videos can greatly enhance user engagement. A travel agency could showcase destination photos or quick video tours to capture viewers' attention.

By using these features, businesses can significantly enhance the impact of their Google Ads, creating compelling ad experiences that drive increased click-through rates and ultimately lead to improved conversion rates.

7. More Numbers

90% of the world’s population love statistics. Sounds persuasive, right? We’ve made up that fact, but not to make fun of you. It’s to show that numbers are powerful in convincing someone to click your ad.

Statistics can make any product or service sound intriguing and worth clicking. Tap into your creativity and use numbers in your headlines or descriptions to make them more attention-grabbing.

"Using numbers instead of lengthy sentences can also make your ad more visually appealing. Think about skimming through a list of search results. One ad describes a smart productivity app that can change your life. Another ad says that their time-management tool will boost your productivity by 50%. Which one would you click? The answer is obvious." – Luca Castelli, CMO, Detectico App

Bottom Line

So, there you have it—your personal guide with 7 highly effective ways to skyrocket your CTR in Google Ads. Apply our tips to your ad campaigns and get results quickly!

If you need help managing, optimizing, and tracking the performance of your Google Ads campaigns, consider trying out an AI-powered paid search automation tool like Marin. Schedule a demo to learn more.

AI search results threaten brand terms, Google > ChatGPT, the new Amazon ad library, and more

Hello there, Digital Darlings,

With any luck you’re having a drama-free week, but it’s time for me to spice things up. Google’s stirring the digital pot again with AI Overviews sneaking into search results–opt-in or not, you’re getting a taste. And with “top ads” not so top anymore, we're left to wonder, what's G's end game? Big things are happening, and I’m here to simplify them for your eager eyes.

AI is coming to dominate the Google SERP.

Google’s beta-testing their newest flavor of search result – AI Overviews. They said they want to collect feedback from searchers who have not opted in to the Search Generative Experience (SGE). Um, what’s the point of having an opt-in option if you’re just gonna serve AI results to whoever you want?! But I digress… According to a Google spokesperson, the AI overviews are being served on a small subset of queries that are more complex and might benefit from combined results from a collection of web pages. Sounds helpful for users, but not so great for us marketers. These AI answers serve at the top of the SERP, pushing down paid search ads and SEO-powered top results. A study found that…

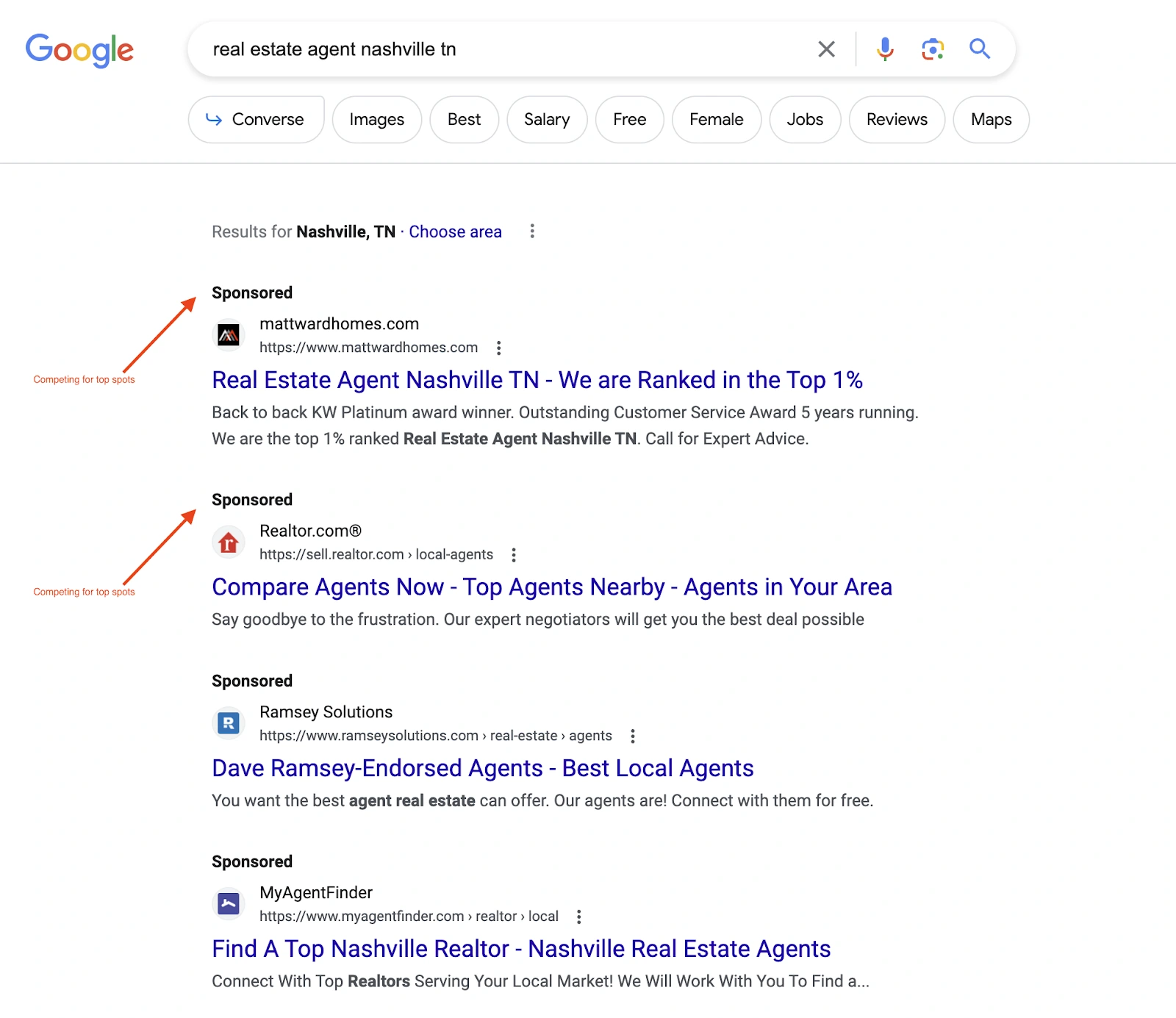

Google SGE is a top threat to brand and product search terms.

In a study by Authoritas, SGE results appeared for 91.4% of queries… so much for them being served to “a small subset”! Paid ads appeared below SGE results about half of the time. Not great for us search marketers! But according to Authoritas the worst part is “these new types of generative results introduce more opportunities for third-party sites and even competitors to rank for your brand terms and related brand and product terms that you care about” since competitor’s pages could be included in the same SGE results as yours. Keep an eye on this one, folks. In other paid search ranking news…

Google changed the definition of ‘top ads’.

Call me crazy, but I assumed that top ads were placed above organic results, at the top of the page… however, Google updated the official definition of top ads to say that they usually appear above organic results, but may show below the top organic results for some queries. It seems like Google may be moving forward with its idea to show ads between organic results, which they tested in 2023. This could be a good thing for advertisers – if Google starts serving ads in traditionally organic placements, that may mean more ad space for sale overall on page 1 of the SERP. Now for my final bit of search news…

Are AI bots a better search tool than Google?

TL;DR… No. A journalist at The Verge took the most commonly Googled queries and fed them to various chatbots to see if AI is the Google search killer everyone’s claiming it to be. And AI lost the fight against Google in numerous ways. For navigational searches, like Googling ‘Amazon’ to get to amazon.com, AI flopped. For informational queries, like ‘current NFL game scores’, AI was often straight-up wrong… another flop. The takeaway was – rather than AI being a Google-killer, it’s more likely Google will incorporate AI in its search results, offering the best of both worlds. And they’re already doing it with SGE, so we won’t be seeing the end of Google any time soon. Now let’s gossip about another Google product…

Google Analytics was bugging yesterday, showing zero real-time traffic.

If you noticed zero real-time traffic in GA4 yesterday, your site didn’t suddenly drop off. Google confirmed a bug was causing this metric to appear empty. They rolled out a fix late US-time last night, so you should be all set now. I just wanted to let you know that if you saw those zeros yesterday… it wasn’t just you! Anyways, in the world of eCommerce…

The EU is forcing Amazon to publish an ads library.

As a result of the Digital Markets Act, Amazon will have to provide a publically accessible library of all ads running on its platform. This is great for transparency, sure, but I’m more excited about the ability to search for my competitor’s ads. If you haven’t read our post about using the Facebook Ads library for competitive analysis, check it out to understand why this is an exciting thing for us advertisers. And I have some other exciting news for B2B marketers in particular…

LinkedIn’s new feature enables users to chat with brands.

It’s called ‘Pages Messaging.’ Activating this feature will produce a ‘Message’ button on your company’s LinkedIn page so users can easily reach out to you and ask questions or schedule demos. In the world of LinkedIn marketing, brands benefit from posting like people. Now, users can chat with brands like they’re people too.

That's the scoop for this week, my digital darlings. In the dynamic digital marketing world, staying static isn't an option. Let's adapt, innovate, and maybe enjoy a little schadenfreude watching our competitors scramble to keep up. Until next week, stay sassy, stay savvy.

You know you love me.

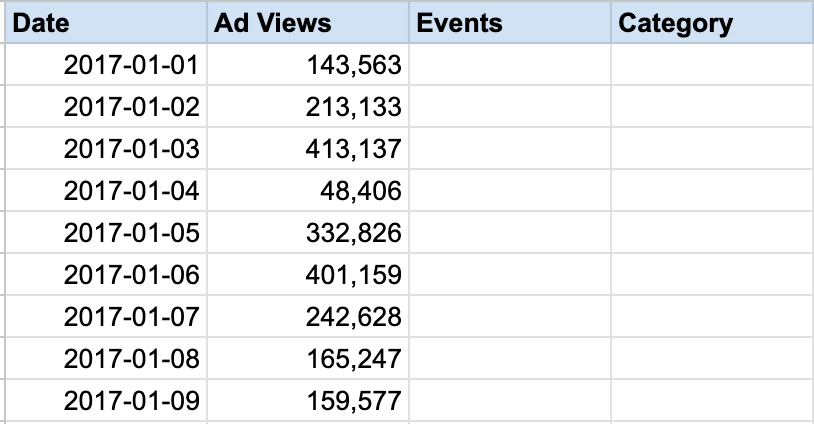

How to Use Lead Segmentation for Targeted Marketing Success

The true purpose of marketing is to match your product offerings with consumer needs. You’re encouraging leads down the sales funnel by appealing to the audience that most desires your goods and services. However, there’s no one-size-fits-all approach.

Different audiences have different wants and needs that can’t be satisfied by a single advertising initiative. Enter lead segmentation, a strategy that lets you offer varied products to a range of consumers.

Segmentation plays a critical role in personalizing marketing messages with the aim of turning leads into customers. Siphoning your target audience into specific customer types based on shared characteristics helps your company reach out in the most targeted and effective ways.

All this results in better lead retention and sales. It’ll also help you understand your customers and thus keep you informed of the best direction to grow your business. Read on to learn more about how and why you should segment leads.

What is lead segmentation, and why is it important?

Lead segmentation is the process of dividing a leads list or existing customer base into smaller groups according to specific characteristics, interests, or behaviors.

This might include demographics such as a customer’s income level, job title, or location. Alternatively, you could create lists for online user actions like content downloads or transactional information like purchase history.

Interchangeably known as audience or customer segmentation, it can help you tailor your approach to customers based on their readiness to buy or potential lifelong value to your business.

Why does all of this matter? Segmentation is effective. It allows organizations to create personalized content for specific groups of potential customers. If you work with marketing agencies, it also gives them a clear strategy for creating targeted, effective campaigns.

Take L’Oréal, for example. The personal care company used behavioral data from Google to create 12 ad variations, each with music targeted towards a different demographic’s preferences. Here, L’Oréal managed to maintain its relevance among multiple customer bases.

It’s applicable to other industries, too. Say you’re a financial institution looking to improve your debt management lead generation. You might utilize customer segments to determine which customers have outstanding debt and send them payment reminders.

The benefits of using lead segmentation in marketing

We’ve touched on a few benefits of creating meaningful segments for your marketing efforts. But there are several other ways it can help you develop a more targeted marketing strategy.

Refines content marketing relevancy

Without segmented lists that address the specific needs of a subset of consumers, you’re casting a broad net.

Do you want to generate leads using content that is relevant to your consumers? Then you need to categorize your audience into particular shopper subsets and refine your content distribution strategy to target each group.

Look at how Coca-Cola tailors its adverts and the products it pushes depending on the tastes of local demographics. While it focuses on Coke as its top product in America, in Brazil, Fanta takes center stage.

Allocates marketing resources effectively

When it comes to optimizing marketing efforts, you don’t want to waste time and money on audiences that aren’t receptive to particular campaigns or strategies.

With relevant and targeted campaigns, you can better allocate resources while reducing customer acquisition costs. This means it’ll be cheaper to attract high-quality leads and move them down the sales funnel.

Looking for inspiration for personalized social media posts? Consider utilizing segmentation to tailor your content to specific audience subsets, maximizing engagement and conversion rates.

By leveraging social media analytics tools, you can gain valuable insights into audience preferences and behavior, allowing you to refine your segmentation strategies for even greater effectiveness.

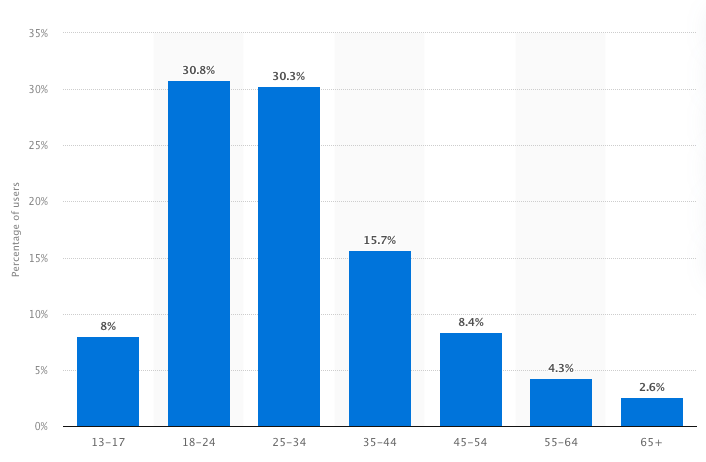

It also means you can focus on the sales and marketing channels that are most effective for each customer subset. Personalized social media marketing might be the best strategy for Gen Z and Millennials, while Gen X could prefer email marketing.

Provides insights to identify new opportunities

Implementing segmentation can help you uncover new opportunities in your industry. Specifically, it will help you identify high-value prospects and opportunities to drive growth.

Netflix, for example, employs behavioral segmentation to personalize content recommendations based on user habits.

Suggesting movies and shows that different customer profiles will be interested in means viewers stay engaged and ultimately increases customer retention. The customer data gleaned from this also helps Netflix to determine what types of shows and films to produce next.

They’re not alone. Many modern companies across different industries use data to seek new opportunities internally and externally. Johnson & Johnson uses data intelligence to optimize their supply chain.

What is supply chain optimization? It’s the process of making tweaks to improve efficiency in everything from processing orders to identifying cost improvements. Combined with segmented lead data, it means you’ll be armed with insights to better serve customers.

Develops targeted lead nurturing strategies

Segmented campaigns help you build meaningful and ongoing relationships with customers. You can anticipate their needs by interpreting habits and behavioral data. As a result, you can offer subgroups the right incentives and benefits to make further purchases.

You’ll also reduce churn by identifying the key reasons that customers abandon your business for another. More targeted incentives show shoppers that they’re valued, keeping them loyal and interested in your brand.

Let’s say you work in the renewable energy sector, for example. You could boost solar leads appointments and reduce churn with targeted nurturing strategies for specific demographics. So, you might offer a reduction in the cost of installation for young or first-time buyers.

Aligns marketing and sales efforts

With a better understanding of the key issues, characteristics, and shopping habits of your target audience, your sales and marketing teams can work more efficiently and effectively. What’s more, they can use segmented data to collaborate on their sales and marketing plans to focus on specific products, demographics, and sales locations.

How to get started with lead segmentation

To implement segmented campaigns, you should outline a goal for the project and segment leads that are most likely to generate the target sales. Consider the following in your segmentation plan:

Define your target audience

Lead segmentation starts with identifying the consumers you’ll target based on their transaction histories, demographics, locality, etc. To aid in this step, you can create a selection of personas that represent each consumer subcategory.

Developing these will require you to collect data on an ongoing basis. You can find this type of data using tools and platforms like your CRM, web analytic services, and marketing automation platforms like Marin.

Analyze customer behavior

Analyzing customer behavior means identifying patterns and commonalities in your data that’ll help you group your target audience into categories and create personas to represent each subgroup.

Consider using AI to save time here. AI tools can automate the process of identifying trends in customer feedback and provide relevant insights about customer activity and identity. For example, sentiment analysis will categorize consumer opinions based on the feedback provided and the demographic of respondents.

Furthermore, AI-driven talent management can assist in optimizing marketing efforts by identifying skill sets within a team that align with specific segmentation strategies, ensuring effective execution and continuous improvement.

By leveraging AI-driven talent management, marketing teams can not only refine segmentation strategies but also foster a culture of innovation and adaptability, driving long-term success in targeted marketing campaigns.

Utilize marketing automation

Advanced marketing automation tools can even go as far as segmenting customers for you based on common characteristics. You can determine if these groupings are broader (e.g. by geography) or more specialized (e.g. customers that use a specific payment method on your website).

A marketing data pipeline tool like Marin can unify all your data so that it's simpler than ever to analyze.

Additionally, personalized email marketing campaigns can be automated to target segmented customer groups with relevant content, driving higher engagement and conversion rates.

A quick word of advice here: ensure any automation tool you use prioritizes safety. Just as vendor risk management benefits include making efficiencies to your systems, be aware that there are risks associated with automation, including cyber-attacks and data breaches. To mitigate these, monitor your software diligently and take steps to encrypt your network.

Create segmentation criteria

You want to focus on market segments that are the best for your business in terms of profitability, size, and growth potential.

The key to finding the right segmentation criteria is tracking patterns in the customer data you’ve gathered. Research your audience behavior and consider the practical value of different segmentations.

Throughout this process, consider market segments that are:

Measurable: Do you actually have data on a specific audience regarding sales value and volume?

Substantial: Is this segment large enough and sustainable enough to make it worth spending resources on?

Accessible: Do you have the resource capacity to reach and target this group effectively?

Actionable: Is this practical? Is your chosen segment likely to be receptive to your marketing efforts?

Choose the right segmentation methods

With that criteria in mind, it's time to divide your leads. Methods will vary from business to business, and you should pick strategies that work best for your team.

- Demographic segmentation: Based on factors related to human populations, such as age, gender, nationality, marital status, and income.

- Psychographic segmentation: Based on studying users' traits and values. This might include personality, desires, attitudes, interests and lifestyle differences. For example, you might choose to target eco conscious customers.

- Transactional segmentation: Based on users’ online behavior, such as purchase and browsing history, frequency of purchases, total spend, type of items bought, and date of last purchase. Customers who purchase frequently or spend a significant amount with your company each month make great leads to target.

- Geographic segmentation: Based on where people live, this method considers weather, regional holidays, and languages. This means you would promote swimwear during warmer seasons, for example.

Integrate with CRM systems

You can streamline segmentation efforts with the integration of various CRM tools. The best CRM systems will identify your leads and present the relevant information associated with them. You can create groupings using CRM rules and workflows.